What is a Suspense Account: Definitions | Examples | Purpose

Overcoming Challenges with QuickBooks Integration in E-commerce

May 9, 2024

Operating Cycle Formula: The Only Guide You’ll Need!

May 23, 2024What is a Suspense Account: Definitions | Examples | Purpose

No other profession in the world requires the level of accuracy often expected from an accountant. Yet there are times when transactions can’t be fully revealed or classified immediately. This is where a suspense account comes in to avoid major issues relating to accuracy.

However, recording suspense account entries is not the final step. It is essential to follow up on such entries, identify the root cause, and solve the problem to clear the suspense account balance as soon as possible.

Here’s all you need to know about suspense accounts;

What is a Suspense Account?

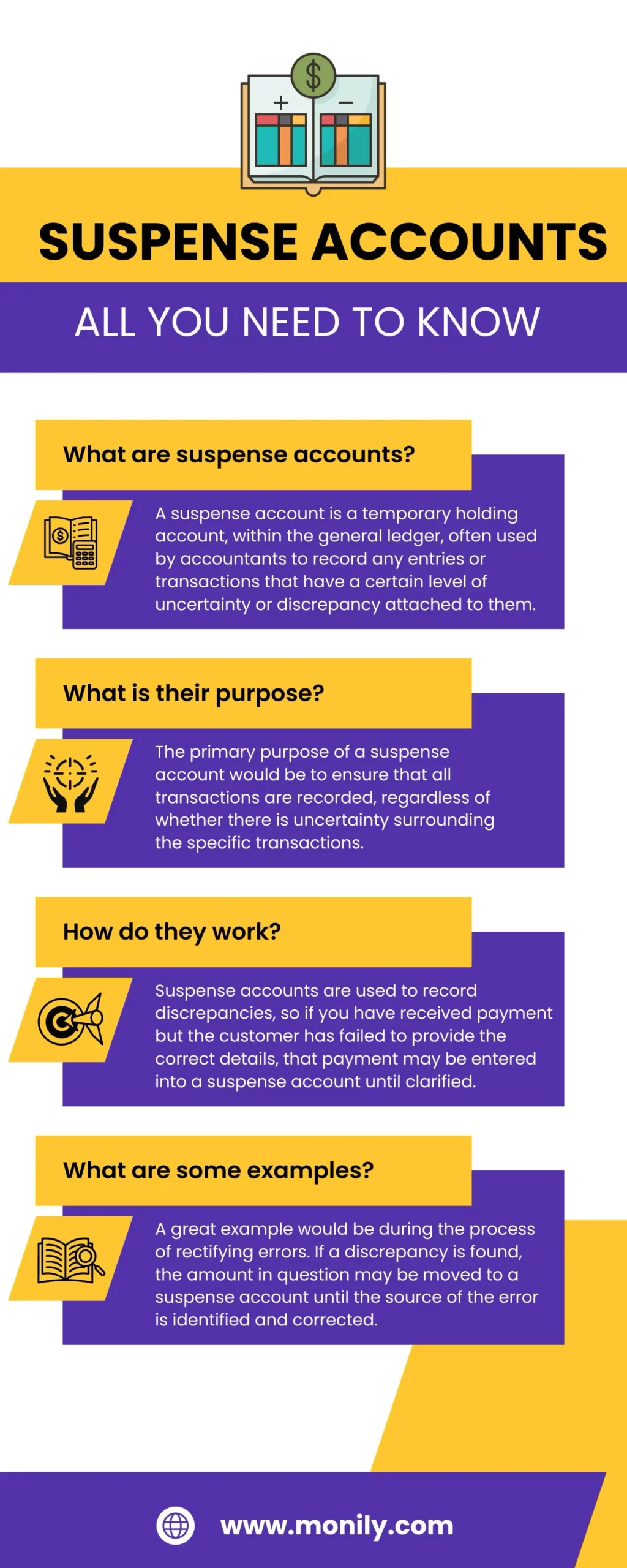

A suspense account is a temporary holding account, within the general ledger, often used by accountants to record any entries or transactions that have a certain level of uncertainty or discrepancy attached to them.

The purpose of such an account is to temporarily hold these uncertain transactions until any further information is added to it. This allows for said transactions to be correctly classified when the time comes and to be allocated to the appropriate accounts.

Suspense accounts are pretty important in the world of accounting. They are primarily used to maintain the integrity of accounting records, especially in complex financial environments where accountants are used to recording multiple transactions daily.

According to Gartner, nearly three in five accountants make data entry related errors each month. All the more reason to understand and carefully evaluate all aspects of financial reports before settling down to update those records.

The Purpose of a Suspense Account

The primary purpose of a suspense account would be to ensure that all transactions are recorded, regardless of whether there is uncertainty surrounding the specific transactions. By doing so, delays and errors are minimized, and records are always up-to-date.

This practice is crucial for companies that want to maintain the integrity of their financial data and ensure that all activities are accurately reflected.

Suspense accounts are also a great addition to maintaining transparency. Financial reporting is sensitive and can, at times, be the difference between getting that initial investment or failing to get funding. Add to that a bad audit report, and you can kiss those funds goodbye.

Auditors can trace the origins of transactions recorded in suspense accounts during an audit and verify their accuracy. This transparency is essential for building trust with stakeholders and regulatory bodies.

How Does a Suspense Account Work?

Suspense accounts are used to record discrepancies, so if you have received payment but the customer has failed to provide the correct details, that payment may be entered into a suspense account. Until the issue is resolved, this entry will remain in the suspense account.

However, once that error has been credited and you receive your payment, the entry is moved from the suspense account into the designated account.

Keep in mind that entries within the suspense account aren’t always going to remain there. In fact, if all of the issues within the suspense account have been cleared, it should technically have a balance of 0!

Suspense Account Meaning: Diving Deep

Here are some suspense account examples that may help you understand them better;

1. Suspense Accounts Examples in Daily Operations

Picture a business that receives a payment from a client who fails to provide enough information to identify the nature of the payment. Instead of leaving the entire transaction unrecorded, the company may choose to place it in a suspense account temporarily.

Once the necessary information regarding the payment is received, the transaction can be transferred from the suspense account to the designated account.

These kinds of scenarios are common in large corporations, where multiple incoming payments are the daily norm. These payments may often lack specific details, making it hard for them to be accurately recorded. Suspense accounts serve as an interim solution.

2. Suspense Accounts in Error Correction

A great example of a suspense account entry would have to be during the process of rectifying errors. If a discrepancy is found, the amount in question may be moved to a suspense account until the source of the error is identified and corrected.

This allows accountants to continuously monitor and adjust the entries without affecting the integrity of the overall records.

For instance, if a transaction is mistakenly recorded twice, the excess amount can be placed in a suspense account while the error is investigated and corrected. This practice is common in industries with complex financial transactions, such as banking and finance.

3. Suspense Accounts in Banking

In the banking industry, suspense accounts are commonly used to handle unidentified deposits. For example, if a customer makes a deposit but fails to provide sufficient details for the bank to identify the account, the deposit is placed in a suspense account. The funds remain in this account until the customer provides the necessary information to allocate the deposit correctly.

4. Suspense Account Meaning in Real Estate: Mortgage Suspense Account

In real estate, suspense accounts are often used to manage funds related to property transactions. If there are discrepancies in the amounts paid or received, these funds may be placed in a suspense account until the issues are resolved. This practice ensures that all the funds are accounted for accurately, and it also prevents future disputes.

For instance, during the sales of a property, payments from buyers might be placed in a suspense account if there are issues with the transaction details. Once the discrepancies are resolved, the funds are transferred to the appropriate accounts.

A mortgage suspense account is a catch-all account that would often be used to temporarily hold funds in case a customer overpays or underpays their monthly installments. So, in case a customer fails to pay part of their monthly installments, the funds will go into the suspense account until they are returned. Once returned, they are simply allocated appropriately.

FAQs

1. Where does a suspense account go?

A suspense account is often recorded in the general ledger. Suspense accounts can be used both as an asset and a liability. If it is an asset, the suspense account would be a current asset as it holds payments that are related to accounts receivables.

2. What is a general ledger?

A general ledger is often the part of your financial records where your assets and liabilities are recorded on an ongoing basis. This ledger can be divided into many different categories or accounts. Suspense accounts are often used for assets or liabilities and may require further clarification to be adjusted or added where they belong.

3. How are suspense accounts and clearing accounts different?

Suspense accounts and clearing accounts are both used to record transactions on a temporary basis, at least until those transactions have been assigned to their respective place in the general ledger. However, in the case of suspense account, there is often an added issue that may need resolution.

4. When should a suspense account be used?

A suspense account should be utilized whenever you need to record something that cannot be categorized accurately at the time of payment. Suspense accounts are often used to record transactions temporarily until the issues associated with them have been resolved.

5. Is a suspense account good or bad?

Generally, at the time of recording, a suspense account might not denote anything that is immediately good or bad in nature. However, holding a balance in the suspense account for a longer period of time without resolving it might not reflect well on the business. Thus, transactions in the suspense account should be cleared on a regular basis, and the root cause should be identified early on.

6. What types of errors are recorded in the suspense account?

Although the suspense account records different kinds of errors, some of the common ones would have to be errors that cause discrepancies between the debit and credit totals of the trial balance. It can also include a debit entry into one ledger account with no parallel credit entry in another. Moreover, differing amounts in the debit and credit entries would also count as an error.

Final Thoughts

A suspense account is an essential tool in the accounting process, designed to handle transactions with uncertainties or discrepancies. By temporarily holding these transactions, suspense accounts ensure that all financial activities are recorded accurately and transparently. Proper management and regular review of suspense accounts are crucial for maintaining accurate financial records and facilitating smooth audits.

Understanding the purpose and examples of suspense accounts highlights their importance in various industries, including banking and real estate. By using suspense accounts effectively, organizations can enhance the reliability of their financial reporting and maintain the integrity of their accounting systems.

The role of suspense accounts in maintaining accurate financial records and facilitating smooth audits cannot be overstated. As highlighted by the various statistics and examples, they are indispensable tools for accountants and auditors alike. Proper management and regular review of suspense accounts ensure that all transactions are correctly classified and recorded, supporting the overall financial health of the organization.

Wajiha Danish

Wajiha Danish is the Director at Monily, overseeing financial strategies and operations for small and medium businesses. She has over 18 years of experience, including her role as Controller at HOCHTIEF PPP Solutions North America. Wajiha's background includes significant roles at Pakistan Petroleum Limited and A.F. Ferguson & Co. (PwC Pakistan). She is a Chartered Certified Accountant (ACCA) and Certified General Accountant (CGA) with expertise in financial management and project finance.