July 12 2024 | By Farwah Jafri | 10 minutes Read

What is Catch Up Bookkeeping?

Signs Your Business Needs Catch Up Bookkeeping Services

1. Unreconciled Bank Accounts

2. An Overwhelming Backlog of Transactions

3. Inconsistency in Financial Reporting

4. Missed Tax Deadlines

5. Cash Flow Problems

6. Difficulty in Securing Financing

7. Overwhelmed with Bookkeeping Tasks

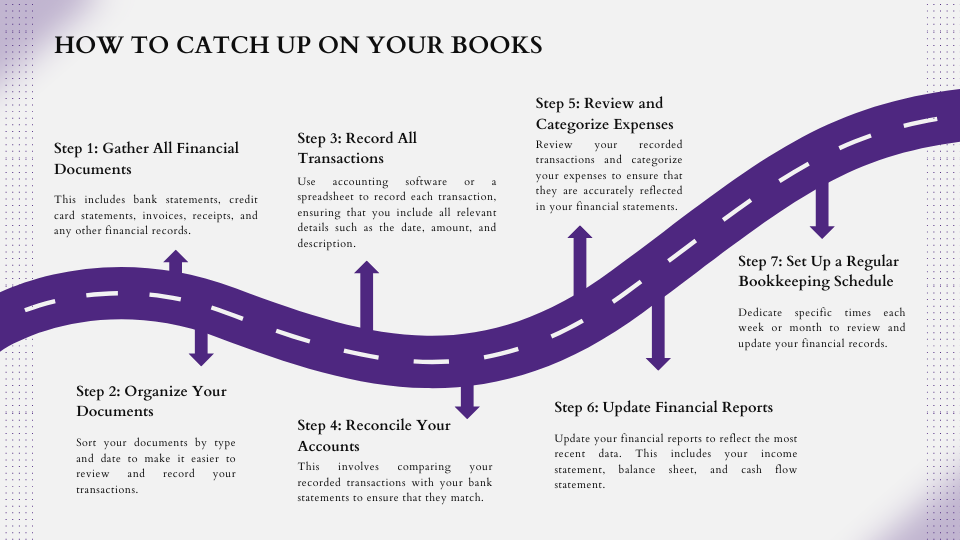

How to Catch Up on Your Own Books

Step 1: Gather All Financial Documents

Step 2: Organize Your Documents

Step 3: Record All Transactions

Step 4: Reconcile Your Accounts

Step 5: Review and Categorize Expenses

Step 6: Update Financial Reports

Step 7: Set Up a Regular Bookkeeping Schedule

Why Hire a Professional for Bookkeeping Catch Up Services?

1. Time, Money, and Knowledge

2. Compliance with Regulations

3. Peace of Mind

FAQs

What is catch up bookkeeping and why is it important?

What are the signs that my business needs catch up bookkeeping services?

Can I do catch up bookkeeping on my own?

What are the benefits of hiring a professional for catch up bookkeeping services?

How long does it take to catch up on bookkeeping?

How much do catch up bookkeeping services cost?

Can catch up bookkeeping help with tax audits?

What tools are recommended for catch up bookkeeping?

How often should a business perform bookkeeping catch up?

Final Thoughts

The world of business is moving at a quicker pace than ever before, and maintaining up-to-date financial records has become more important than ever before. However, quite a lot of businesses, especially smaller and medium-sized enterprises (SMEs), are known to routinely fall behind on their bookkeeping tasks.

This lapse can lead to confusion in financial records, missed opportunities, and compliance concerns. Catch up bookkeeping emerges as a viable solution – a lifesaver for businesses that need to bring those financial records back on track.

The following sections explore what catch up bookkeeping is, sings your business may need catch up bookkeeping services, and how you can manage this task on your own. We will also touch upon some of the benefits of hiring a professional for this essential service.

Catch up bookkeeping is the process of updating and reconciling financial records that have fallen behind. This situation can arise due to various reasons, which include a lack of time, resources, or sufficient expertise.

The goal of catch up bookkeeping is ideally to ensure that all financial transactions are recorded accurately, categorized, and reconciled exactly how they should be. Essentially, your financial records should provide you with a clear picture of your business’ financial health. This process typically involves reviewing bank statements, invoices, receipts, and other financial documents to ensure all your transactions are properly accounted for.

Catch up bookkeeping is pretty important if you want to maintain accurate financial records. Accuracy in record-keeping directly translates to better, more informed business decisions. It also allows you to file your taxes correctly and ensures compliance with financial regulations.

Without updated bookkeeping, you might struggle with managing your cash flow, budgeting, and creating financial forecasts. This reduces your chances of surviving against the tough competition in the business world!

Here are some of the common signs your business might be in need of catch up bookkeeping services;

One glaringly obvious sign to watch out for would be your business experiencing the presence of unreconciled bank accounts. If your bank statements do not match your financial records, it indicates that there are unrecorded transactions or errors in your books.

Failing to recognize these in time or to remedy them when noticed leads to inaccurate financial reporting which can cause lapses in judgment when you attempt to analyze your cash flow at the end of the year or quarter.

If your pile of unrecorded transactions continues to grow, that is a great sign that your business has begun to lag when it comes to its bookkeeping. This backlog often includes unpaid invoices, unrecorded expenses, and unreconciled bank transactions as discussed previously.

An overwhelmingly large backlog can make it difficult for you to track your financial performance and identify any discrepancies or issues that need attention. It can also be quite difficult to resolve if you don’t have a trained financial advisor or expert bookkeeper on board.

Are you finding it hard to maintain consistent reports? If your financial reports show significant inconsistencies, that’s a clear sign that your books are not up to date. Inconsistent financial reports can lead to poor decision-making as you would not have a clear understanding of your business’s financial health.

Catch-up bookkeeping services can help rectify these inconsistencies and provide accurate financial reports. However, for that, you may need to consult a professional!

Missing tax deadlines is a major red flag that your bookkeeping is in disorder. Without accurate and up-to-date financial records, it’s challenging to file your taxes correctly and on time. This can lead to penalties, fines, and potential audits from tax authorities. Catch up bookkeeping services can help ensure that your financial records are accurate and that you meet all tax deadlines.

The cash flow of a business is its lifeline. The poorer your cash flow management, the more alarming it would be for any potential investor. That is because it points towards an obvious issue in your financial records.

If you are constantly facing cash flow issues, it might be due to your financial records not being up to date. Catch up bookkeeping services can help you gain a clearer understanding of your cash flow situation, allowing you to manage your finances more effectively.

Lenders and investors require accurate and up-to-date financial records to assess the financial health of your business. If you are having difficulty securing financing, it may be due to outdated or inaccurate financial records. That’s also one of the tell-tale signs that you need catch up bookkeeping.

Falling behind on bookkeeping can lead to stress and burnout, impacting your overall productivity and efficiency. If you or your team are feeling overwhelmed with bookkeeping tasks, you may need bookkeeping catch up services to clean up past records and lighten the burden.

Here are some steps you could follow;

The first step in catching up on your own bookkeeping is to gather all relevant financial documents. This includes bank statements, credit card statements, invoices, receipts, and any other financial records. Having all your documents in one place will make it easier to review and reconcile your transactions.

Once you have gathered all your financial documents, the next step is to organize them. Sort your documents by type and date to make it easier to review and record your transactions. This step is crucial for ensuring that you don’t miss any transactions and that your financial records are accurate.

With your documents organized, it’s time to start recording your transactions. Use accounting software or a spreadsheet to record each transaction, ensuring that you include all relevant details such as the date, amount, and description. Be meticulous in recording every transaction to ensure that your financial records are accurate.

Reconciliation is a critical step in catch up bookkeeping. This involves comparing your recorded transactions with your bank statements to ensure that they match. Reconciliation helps identify any discrepancies or errors in your financial records, allowing you to correct them and ensure accuracy.

Review your recorded transactions and categorize your expenses to ensure that they are accurately reflected in your financial statements. Proper categorization helps you understand your spending patterns and identify areas where you can cut costs or improve efficiency.

Once you have recorded and reconciled all your transactions, update your financial reports to reflect the most recent data. This includes your income statement, balance sheet, and cash flow statement. Accurate and up-to-date financial reports are essential for making informed business decisions.

To prevent falling behind on your bookkeeping again, set up a regular bookkeeping schedule. Dedicate specific times each week or month to review and update your financial records. Consistency is key to maintaining accurate and up-to-date financial records.

Here are some of the reasons a professional is a better choice if you are looking to get your past records cleaned up and organized;

Professional bookkeepers, even if they are outsourced, have the knowledge required to save you time and money in the long run. Their expertise and industry experience allows them to handle your catch up bookkeeping requirements with the expected accuracy.

These services allow your records to remain up to date and compliant with regulations. Plus, they save you a significant amount of time. Instead of spending hours trying to catch up on your bookkeeping, you can focus your time on running and growing your business.

You also get to enjoy accuracy in financial records which saves you money. Once you identify and correct any discrepancies in said records, you can rely on your financial records with peace of mind.

Compliance with financial regulations is crucial for any business. Professional bookkeepers ensure that your financial records are compliant with regulations, reducing the risk of penalties and fines. They stay up to date with the latest regulatory changes and ensure that your financial records are accurate and compliant.

Accuracy in financial recordkeeping is a basic stepping stone that allows you to maintain the kind of records that pass through all audits and tax hurdles in the long term. They also give you much more control over your financial management in the longer run.

Hiring a professional for catch up bookkeeping services gives you peace of mind. Knowing that your financial records are accurate and up to date allows you to focus on your business without worrying about bookkeeping tasks. Professional bookkeepers provide reliable and accurate financial information, giving you confidence in your financial management.

Catch up bookkeeping is the process of bringing a company’s financial records up to date after a period of neglect. It ensures accurate financial reporting, compliance with tax regulations, and better decision-making based on up-to-date financial data.

Signs include missing financial records, delayed financial statements, cash flow problems, and tax filing issues.

Yes, you can, but it requires time, effort, and a good understanding of bookkeeping practices. Whereas, with a professional bookkeeper by your side, you can get the job done and exhaust half of the effort and resources you would otherwise.

Professionals offer expertise, accuracy, efficiency, and can help you avoid costly mistakes. Plus, they can help you automate many of your bookkeeping tasks, which means you can avoid inaccuracies in the long run too!

The duration depends on the extent of backlog and the complexity of your financial transactions. However, a professional can help you get the job done in less time!

Costs vary based on the service provider, the volume of transactions, and the time required to complete the task. Contact the team here at Monily and book a consultation today to get customized pricing!

Yes, up-to-date financial records are crucial for a smooth and compliant tax audit process. With lesser inaccuracies in your financial records, you are much less likely to be subjected to penalties.

Tools like QuickBooks, Xero, and other accounting software can help add structure to the process.

Ideally, businesses should maintain regular bookkeeping, but periodic catch up may be necessary if records fall behind from where they should be.

Catch up bookkeeping is an essential process for businesses that have fallen behind on their financial records. It involves updating and reconciling financial transactions to ensure accuracy and compliance.

Recognizing the signs that your business needs catch up bookkeeping services, such as unreconciled bank accounts, inconsistent financial reports, and cash flow problems, is crucial for maintaining financial health.

While it is possible to catch up on your own bookkeeping by gathering and organizing financial documents, recording transactions, and reconciling accounts, hiring a professional can save time, ensure accuracy, and provide valuable insights. Professional bookkeepers offer expertise, experience, and peace of mind, making them an invaluable resource for businesses seeking to maintain accurate and up-to-date financial records.

By understanding the importance of catch up bookkeeping and taking proactive steps to address any backlogs, businesses can ensure they have the financial clarity needed to make informed decisions and drive growth. Whether you choose to handle the process yourself or hire a professional, keeping your bookkeeping up to date is essential for the long-term success of your business.

Looking for a professional to help you through catch up bookkeeping? Contact our experts today and book a consultation to get customized pricing for all our catch up services.

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

In the world of small businesses, managing finances can quickly become overwhelming. Enter the bookkeeper – a financial wizard who keeps your accounts in order, ensuring […]

Learn More →

In today’s digital world, small businesses are in for a tough time when it comes to managing their finances. Traditional bookkeeping methods are a real drag […]

Learn More →

The emergence of AI has impacted a number of sectors, including bookkeeping. AI bookkeeping solutions have been growing in popularity among small firms in recent years […]

Learn More →