May 30 2025 | By Wajiha Danish | 6 minutes Read

What is Small Business Bookkeeping Anyway?

Why is Small Business Record Keeping So Crucial?

1. Stronger Financial Control

2. Simplified Tax Season

3. Improved Cash Flow Management

4. Better Business Planning

5. Easier Access to Loans and Funding

6. Compliance and Legal Protection

What Records Should Be Kept?

Unlock Financial Success with Small Business Record Keeping

Running a small business is not an easy task. Catering to customers’ needs, looking out for marketing trends, and ensuring the best service or product in a heavily competitive market – who says it’s easy?

Amidst all this, one very important part of doing business is often neglected i.e. record keeping. And while you may feel like small business record keeping is a chore that needs to be attended to during the tax season, let us tell you the reality. Small business record keeping is in fact, the single most powerful tool that can help your business unlock new success, spend your money wisely, and make the best decisions backed by financial confidence.

So, if you’re ready to learn about the potential of record keeping for small businesses, continue to read this blog. We have a breakdown of everything you need to know about record keeping of your business.

Before we try to convince you that record keeping is a great thing, it’s only fair that we explain to you what it is. Essentially, record keeping for small businesses is all about tracking and saving all the important information regarding your business operations.

This includes invoices, receipts, customer data, employee records, financial transactions, tax documents, and even email correspondence between you and your vendors. And honestly, record keeping doesn’t mean just dumping everything together and scrambling through it later.

Instead, good record keeping for small businesses means not only storing the information but also organizing it in such a way that whenever you need any insight into your business, it’s accessible within minutes. A lot of small businesses these days rely on digital bookkeeping tools to make the process easier.

Do you think record keeping is only for the IRS and tax purposes? Think again! Here’s how your business will benefit from record keeping.

Record keeping for small businesses allows you to keep an eye on revenue, expenses, and profit margins. This means that you know how much money is coming in and where it’s going. Based on this information, you take control of your financial health, essential for your business’ growth.

Did the marketing efforts pay off? Is it time to increase your products’ prices? Should you cut costs in a specific area? No more guesswork! With small business record keeping, you make informed decisions.

Tax season can be stressful, unless you have a habit of maintaining good records. When you have all your receipts, income reports, and expenses sorted, filing taxes becomes much easier and less time-consuming. This also means that you can claim all the deductions which you may have missed if you were scrambling through your records at the last minute.

Cash flow management is presumably the most important thing for a business. With good record keeping, you can easily forecast your income and expenses, thus avoid unexpected surprises. No more running out of funds due to a large bill or the risk of bouncing a payment. With record keeping habits, you always have control over your working capital and know where your finances stand.

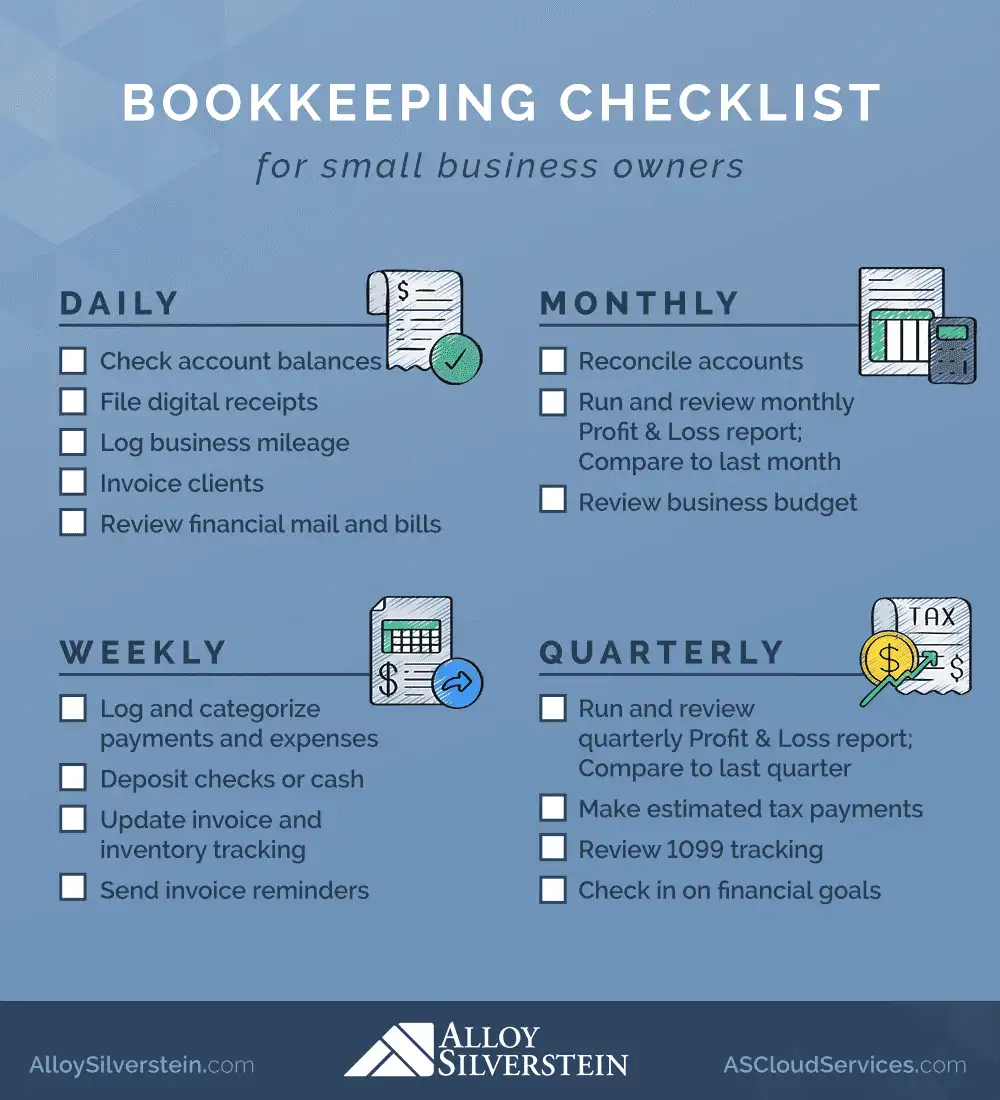

Source: Alloysilverstein.com

From expansion to product diversification, all business decisions need solid planning. And a good small business record allows you to plan confidently and not fly blind. With record keeping, you have the insights needed to set new goals, predict growth, and adopt caution when needed. If you want to grow with certainty, record keeping for your small business comes handy.5

Banks and investors want to know that your business is stable and profitable before risking their loans and funding for you. It’s hard to convince your investors and lenders without anything to show for, and this is where record keeping comes into the picture. With organized and up-to-date records, you can always make a great impression on potential partners, investors, and lenders that you’re looking to pitch to.

Depending on where your business is operating, you may be required by the law to keep records of certain things. Some states may require you to have records of your licenses, tax documents, employee timesheets, and safety training. So, if you have good records, you may be able to avoid penalties and prove your side of the story if things ever come to that. In addition, record keeping also offers you protection in case of audits and legal disputes.

Not sure about which records are important to keep? Here’s a list:

Small business record keeping isn’t just a boring chore, instead it’s one of the most powerful tools you need to take your business to new heights. If you’re unsure about managing your business records and don’t know where to start from, count on our bookkeeping experts at Monily.

We offer monthly, annually, and even seasonal bookkeeping packages to cater to your small business needs. Let us organize and keep track of your records so that you can focus on your core business operations. With us, you grow financially and confidently.

Ready to take your business ahead? Book a consultation with us to learn more about our services.

Turn the chaos of numbers into the calm of success!

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

R&D activities frequently occur in small and medium businesses that use innovation to create space and impact in the industry. More than 30 million small businesses […]

Learn More →

In interviews, people often get asked, ‘where do you see yourself in X years?’ A similar question makes rounds in the business world, ‘’how much money […]

Learn More →

The hunt for a technical co-founder is often the number 1 priority of startup owners. On number two comes the need to establish a solid business […]

Learn More →