October 11 2024 | By Raza Agha | 10 minutes Read

What is Turo and Why Do Taxes Matter?

How to Report Your Turo Income

Deductions You Can Claim as a Turo Host

Should You File Quarterly Taxes?

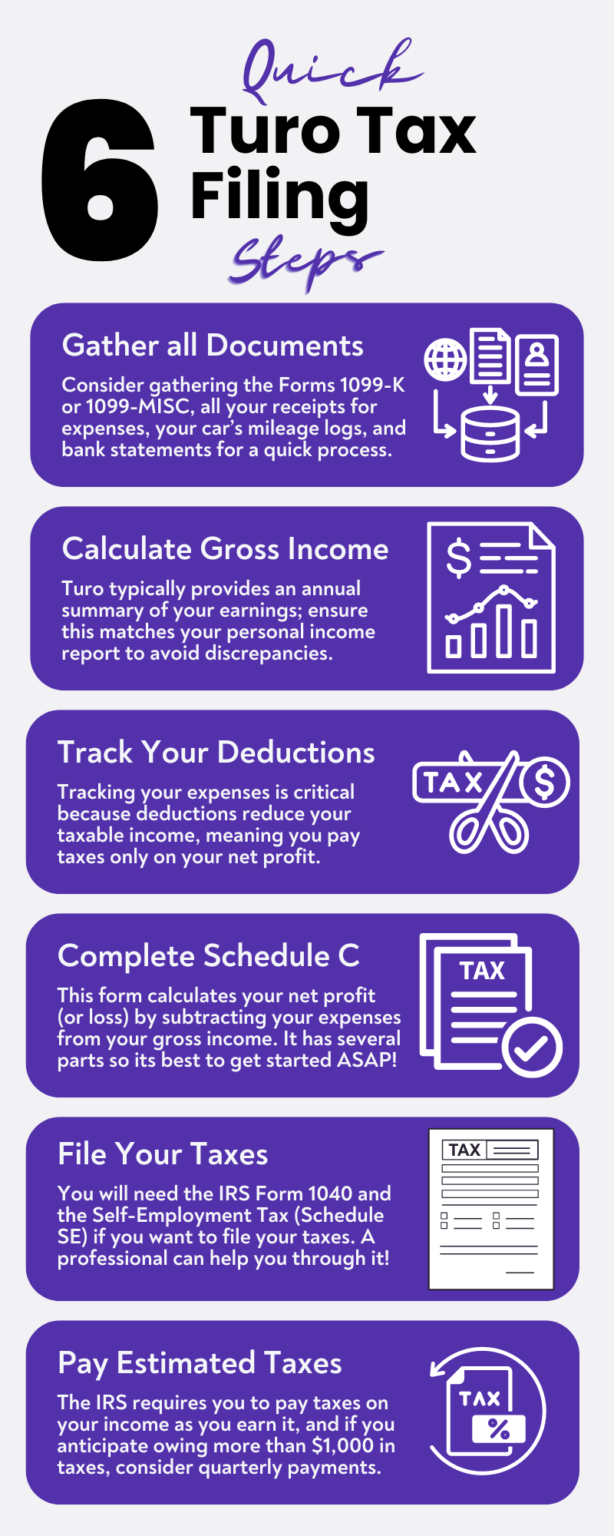

Tax Filing Steps for Turo Hosts

1. Gather All Your Documents

Forms 1099-K or 1099-MISC

Receipts for Expenses

Mileage Logs

Bank Statements

2. Calculate Your Gross Income

3. Track Your Expenses and Deductions

Vehicle Expenses

Depreciation

Advertising and Listing Fees

Interest on Vehicle Loans

4. Complete Schedule C

Key Sections of Schedule C:

5. File Your Taxes

IRS Form 1040

Self-Employment Tax (Schedule SE)

6. Pay Estimated Taxes (if applicable)

Quarterly Due Dates

How to Calculate Estimated Taxes

How to Pay

Extra Tip: Use Tax Software or a Professional

Wrapping It Up

As a Turo host, it can be hard to break down your tax obligations. But with this Turo tax guide, you’ll learn everything you need to know. This information would act as a compass for you while you wade through the difficult waters of filing taxes related to your Turo business.

Whether you’re a new host, own just one vehicle, or an experienced user with a huge fleet, this guide will help you stay compliant, save money, and ensure that you take full advantage of the deductions available to you.

In this Turo tax guide, we’ll walk you through the ins and outs of Turo tax rules, explain how to maximize deductions and provide you with step-by-step instructions on filing. Taxes may seem daunting, but this guide will give you the confidence you need to approach tax season prepared and ready.

Turo is a peer-to-peer car-sharing platform that allows you to rent out your personal vehicle. As a Turo host, you’re running a business, and like any business, you need to comply with tax regulations.

The IRS treats Turo earnings as taxable income, which means you are responsible for reporting your earnings and expenses when you file taxes. Failing to file accurately can lead to penalties and extra costs, so understanding Turo tax responsibilities is crucial.

If you’re new to Turo or unclear about how Turo tax works, this guide will clear up any confusion, ensuring you follow the correct procedures while making the most of the available tax deductions.

As a Turo host, your earnings are classified as income, and you’ll need to report them on your tax return. Turo will issue you a Form 1099-K or Form 1099-MISC if you meet certain thresholds, which will outline your gross earnings. Even if you don’t receive a 1099, you’re still responsible for reporting all income generated through the platform.

Even if your income falls below these thresholds, you still need to report it on your tax return. In such cases, you can use Schedule C (Profit or Loss from Business) as part of your 1040 form to report your income and expenses.

One of the benefits of being a Turo host is that you can claim various deductions to reduce your taxable income. This is a crucial aspect of Turo tax management, as these deductions can significantly lower your tax liability.

Here are the most common deductions:

Being meticulous about tracking these expenses will make it easier to fill out your tax return and ensure you claim every deduction available.

If you’re earning a substantial amount through Turo, you might need to pay estimated quarterly taxes. The IRS requires you to pay taxes on income as you earn it. For most employees, this is done automatically through paycheck withholdings, but as a self-employed individual or business owner, it’s up to you to pay throughout the year.

If you expect to owe more than $1,000 in taxes, it’s a good idea to file quarterly to avoid any penalties. Filing quarterly taxes helps you spread out your payments instead of facing one large bill at the end of the year.

Here are some tips that could help you file those taxes smoothly this year;

The first step in filing your taxes is organizing and gathering all necessary documents. This includes:

If Turo has sent you one of these forms, they will summarize your earnings for the year. If you’ve made over $20,000 and had 200+ transactions, you will receive a 1099-K. For any bonuses, referral payments, or additional earnings over $600, you’ll receive a 1099-MISC. However, even if you don’t receive a form, you are still obligated to report your earnings.

Keep receipts for all business-related expenses, such as car repairs, cleaning, and maintenance costs. These records will help you calculate deductions, lowering your taxable income.

Track your mileage if you’re using your vehicle for both personal and Turo-related purposes. Only business mileage is deductible, and maintaining a log is crucial to determining how much you can claim.

If you made purchases related to your Turo business using your personal bank account or credit card, make sure to have those statements on hand as proof of expenses.

Organizing these documents will make tax filing much smoother, helping you claim all eligible deductions while avoiding mistakes or omissions.

Once you have all your documents, the next step is to calculate your gross income—the total earnings you made from Turo before any deductions. This includes:

Turo typically provides an annual summary of your earnings, either through the 1099 forms or directly in your account, which will give you an overview of the income you need to report. Ensure that the income you report matches what is provided in these summaries to avoid discrepancies.

Tracking your expenses is critical because deductions reduce your taxable income, meaning you pay taxes only on your net profit (gross income minus deductions). These expenses can be direct (related to the vehicle) or indirect (related to running your Turo business). Here’s how to categorize them:

These include costs for maintenance, repairs, depreciation, insurance, and cleaning. You have the option to deduct these either through the actual expense method (deducting specific expenses) or the standard mileage rate (deducting based on mileage driven for business purposes).

If your car’s value decreases due to wear and tear, you can deduct a portion of the depreciation every year. Depreciation is typically calculated using the Modified Accelerated Cost Recovery System (MACRS), but it’s recommended to consult with a tax professional to understand which depreciation method benefits you most.

Any fees you pay to promote your vehicle on Turo or other platforms, including premium listing fees, are deductible as business expenses.

If your vehicle is financed, you can deduct the interest portion of your loan payments proportional to the business use of your vehicle.

Be sure to categorize and organize each expense carefully, so that when it comes time to fill out your Schedule C, you have a clear idea of what deductions you’re eligible to claim.

Schedule C, Profit or Loss from Business, is a crucial part of your tax return as a self-employed Turo host. This form calculates your net profit (or loss) by subtracting your expenses from your gross income.

By completing Schedule C, you’ll determine your net profit, which is the amount of income you’ll pay taxes on after deducting eligible expenses.

Now that you’ve calculated your net income, it’s time to file your taxes. Here’s what you need to do:

The Form 1040 is the standard individual tax return form that every taxpayer must file. As a Turo host, you’ll attach your completed Schedule C to Form 1040 to report your business income and expenses.

If your net earnings from your Turo business are more than $400, you’ll also need to file Schedule SE to calculate your self-employment taxes. This tax includes Social Security and Medicare contributions, which are typically withheld from regular employee wages but must be paid by self-employed individuals like Turo hosts.

If you are filing as an LLC or S-Corp, additional forms may be necessary, so consulting a tax professional is recommended to ensure compliance.

If your Turo earnings are significant, you may be required to pay estimated quarterly taxes to avoid penalties. The IRS requires you to pay taxes on your income as you earn it, and if you anticipate owing more than $1,000 in taxes, you should make quarterly payments. Here’s how it works:

The IRS has four quarterly due dates: April 15, June 15, September 15, and January 15 of the following year. These deadlines help break up your tax liability into manageable payments.

To calculate your estimated tax payments, you can use Form 1040-ES, which includes a worksheet to help you estimate your total annual income and deductions. After estimating your total tax liability for the year, divide it by four to calculate your quarterly payment.

Payments can be made online through the IRS Direct Pay system or by mailing a check along with your completed Form 1040-ES voucher.

Paying quarterly taxes helps you avoid the stress of a large tax bill at the end of the year and protects you from potential IRS penalties.

While it’s possible to file your Turo taxes manually, it can be complex if you have multiple vehicles, additional sources of income, or many deductions. Tax software can simplify the process by walking you through each section and ensuring you don’t miss any deductions.

Alternatively, a tax professional can provide personalized advice, review your forms, and help ensure your compliance with IRS rules. If you’re unsure about depreciation methods, self-employment taxes, or quarterly filings, a professional can guide you through each step and help you maximize your tax savings.

Filing taxes as a Turo host doesn’t have to be intimidating. With this Turo tax guide, you have the tools to navigate the process, claim the right deductions, and avoid common pitfalls. By staying organized, understanding the tax obligations, and using the available resources, you can turn tax season into just another step in managing a successful Turo business.

If you’re feeling overwhelmed or want extra support, consider leaning on Monily’s Turo tax experts to guide you through it all and make sure you’re compliant and maximizing your deductions. With the right strategy, you’ll be ready to file your taxes confidently and make the most out of your Turo hosting experience.

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Scaling your Turo business from a single vehicle to a full-fledged fleet may seem challenging, but with a clear strategy and dedication, it becomes an achievable […]

Learn More →

Driving for Uber or delivering with Uber Eats can be a flexible and rewarding way to earn money. But when tax season rolls around, many drivers […]

Learn More →

Alright, buckle up, Turo hosts! We’re about to embark on a tax-saving road trip, and trust me, you’re going to want to ride shotgun for this […]

Learn More →