Startup Taxation Guide for Founders, Taxes Simplified

1040 vs 1099: Key Differences Every Taxpayer Should Know

October 16, 2025

A Startup’s Guide to Essential Tax Write-Offs and Credits

November 4, 2025Startup Taxation Guide for Founders, Taxes Simplified

Starting a business is quite thrilling, until tax season arrives. For founders, understanding the nitty gritty of startup taxation can make a difference between financial efficiency and costly penalties. And unlike established entities, startups face unique tax challenges related to their early growth stages, funding sources, and evolving business models.

The truth is many new entrepreneurs underestimate how deeply taxes affect their cash flow, valuation, and long-term sustainability. From knowing which structure reduces tax burdens to benefiting from credits for R&D, a well-informed startup tax strategy can shape a startup’s financial future.

This guide looks at everything founders need to know about taxes. From formation to scaling, let’s talk about each stage so you can make informed decisions and stay tax compliant while profiting off your startup.

Source:fastercapital.com

Choosing the Right Business Structure for Tax Efficiency

Your startup’s tax obligations begin with one basic choice, business structure. The structure you choose impacts how profits are taxes, how losses are carried, and what deductions you can claim.

- Sole Proprietorship: Simple and flexible, but profits are taxed as personal income. It’s often suitable for early-stage solopreneurs.

- Partnership: Passes income and losses directly to partners, avoiding double taxation. However, all partners share liability.

- LLC (Limited Liability Company): Offers limited liability protection with pass-through taxation, making it a popular choice among most startup founders.

- C-Corporation: Ideal for startups seeking venture capital funding. Profits are taxed at the corporate level, and dividends are taxed again at the shareholder level. However, C-corps can access the Qualified Small Business Stock (QSBS) exclusion, which can eliminate capital gains taxes on stock sales under specific conditions.

- S-Corporation: Avoids double taxation and allows income to flow through to shareholders but limits the number of shareholders.

Selecting the right structure is about balancing tax efficiency with growth goals. And consulting a tax professional early on can prevent costly restructuring later.

Understanding Startup Taxation and Key Federal Obligations

When it comes to startup taxation, compliance begins at the federal level. Founders must stay aware of the following tax guidelines:

- Income Tax: Based on net earnings after deducting expenses, depreciation, and operating costs.

- Self-Employment Tax: Founders operating as sole proprietors or partners must pay Social Security and Medicare taxes.

- Payroll Tax: Once you hire employees, you must withhold and remit payroll taxes, including federal income tax and FICA

- Estimated Quarterly Taxes: Since startups rarely have taxes withheld, quarterly estimated tax payments prevent underpayment penalties.

- Excise and Sales Taxes: Depending on your industry such as manufacturing, tech, or transportation, you may face additional federal taxes.

It’s essential to register for an Employer Identification Number (EIN) with the IRS and maintain separate financial records. Proper bookkeeping ensures accurate filings and simplified financial reporting for investors as well.

The Startup Taxes Every Founder Should Know Of

Beyond federal taxes, state and local taxes for startups vary widely. Founders often overlook these, only to face penalties or audits later. Common startup taxes include:

- State Income Tax: Not all states levy income taxes but for those that do, rates and rules differ.

- Franchise Tax: Charged for the privilege of doing business in a state; these taxes are often based on net worth of the startup or its revenue.

- Sales Tax: Required for selling tangible goods or digital services in certain states.

- Employment Taxes: State unemployment insurance and workers compensation contributions are mandatory once hiring begins in a startup.

Multi-state operations add complexity, especially when remote employees or online sales create nexus obligations. Founders should track where their business activities generate tax liabilities and use digital tools to stay compliant across jurisdictions.

Deductible Expenses and Tax Credits for Startups

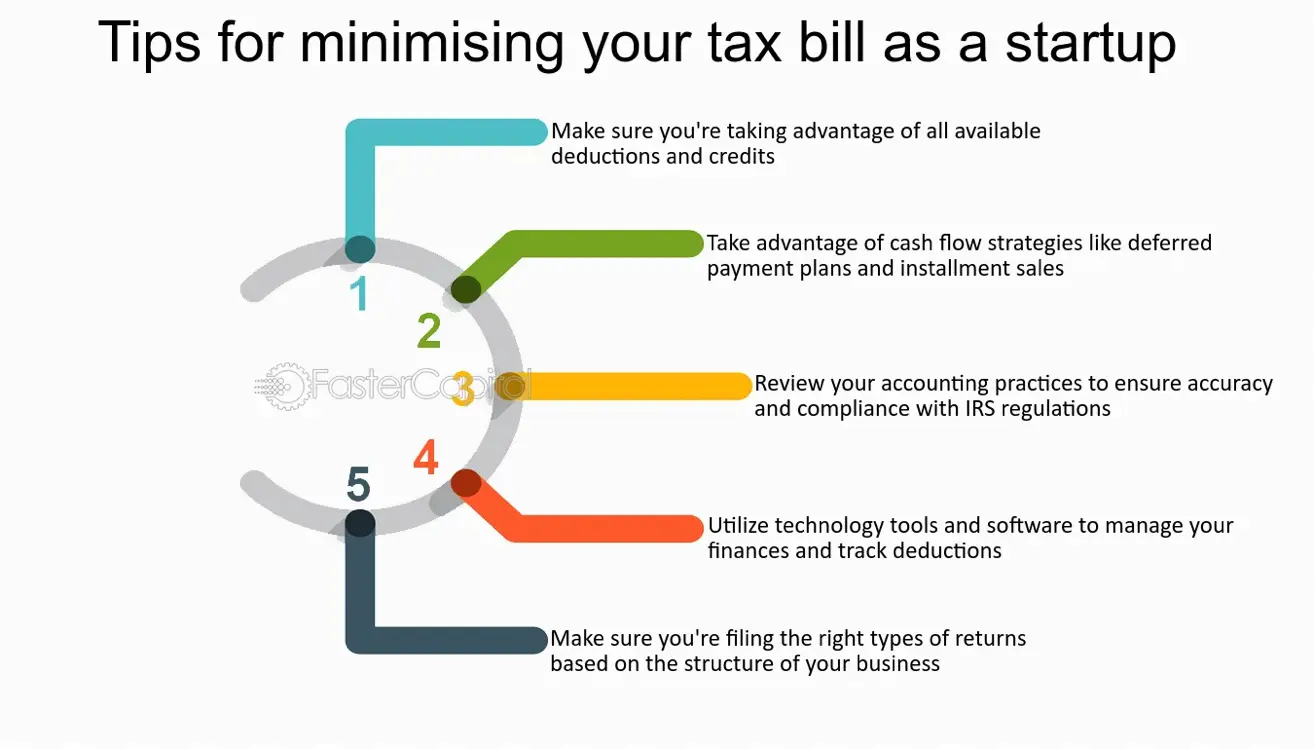

Understanding what qualifies as a deductible expense can significantly reduce your tax bill. Founders often leave money on the table by missing out on these legitimate deductions and credits.

Common Deductible Startup Expenses Include:

- Office rent, utilities, and co-working spaces

- Equipment, software, and hardware purchases

- Marketing and advertising tools

- Professional services (legal, accounting, consultancy)

- Business travel and client meetings

- Insurance premiums

- Depreciation of business assets

Key Tax Credits to Consider:

- R&D Tax Credit: Encourages innovation by offering credits for research and development costs. Startups can even apply this credit to offset payroll taxes.

- Work Opportunity Tax Credit (WOTC): Rewards businesses that hire employees from targeted groups including veterans.

- Energy-Efficient Commercial Building Deduction: For startups operating through sustainable and eco-friendly facilities, this tax credit comes into play.

Documenting every expense meticulously ensures you can justify your expenses while claiming tax deductions and not even a penny extra is left on the table during tax season.

Common Startup Taxation Mistakes Founders Make

Even the most well-intentioned founders can fall into traps that raise alarms with the IRS or increase tax bills. Common startup tax mistakes include:

- Mixing personal and business finances.

- Misclassifying employees as contractors.

- Overlooking estimated tax payments.

- Ignoring state nexus obligations for remote teams.

- Failing to keep detailed expense documentation.

Implementing sound accounting practices and using digital bookkeeping tools reduces these risks. Regular consultation with financial professionals also ensures compliance as your startup continues to grow.

Building a Tax Savvy Startup Future

Startup taxes don’t have to be a founder’s worst nightmare. Instead, understanding the basics of startup taxation empowers entrepreneurs to make smarter financial decisions, avoid penalties, and build long-term value of their venture.

Every stage from ideation to international expansion of a startup comes with unique tax considerations. With proactive planning, accurate bookkeeping, and strategic advice of a tax professional, founders can keep their startups financially health and IRS-compliant.

If you are looking to simplify your startup taxes and improve your financial management, partnering with experienced professionals at Monily can make a huge different. We at Monily specialize in supporting startups with expert accounting, tax planning, and financial reporting solutions all over the US and internationally.

To learn more about our startup taxation services or discuss your specific financial management needs, reach out to us. Book a consultation with our team today and let us assist you with your startup tax, accounting, and bookkeeping needs.

Farwah Jafri

Farwah Jafri is a financial management expert and Product Owner at Monily, where she leads financial services for small and medium businesses. With over a decade of experience, including a directorial role at Arthur Lawrence UK Ltd., she specializes in bookkeeping, payroll, and financial analytics. Farwah holds an MBA from Alliance Manchester Business School and a BS in Computer Software Engineering. Based in Houston, Texas, she is dedicated to helping businesses better their financial operations.