5 Simple Financial Planning Tips Every Small Business Owner Should Know

Stripe vs PayPal: Which Payment Platform Should You Choose in 2026?

November 26, 20255 Simple Financial Planning Tips Every Small Business Owner Should Know

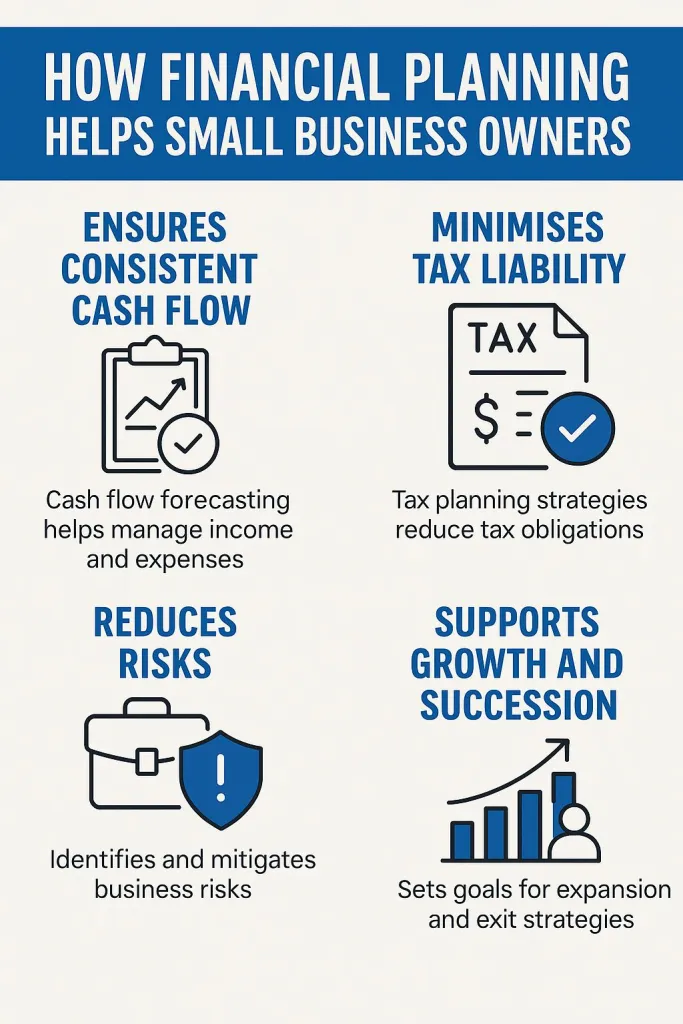

Running a small business is not just about sales, marketing, or growth ideas. Behind every successful business is a clear money plan that supports daily decisions and long-term goals. Many business owners work hard but still feel unsure about where their money is going or how prepared they are for the future. That uncertainty usually comes from weak or inconsistent financial planning.

According to U.S. Small Business Administration data, poor cash flow management and lack of planning are among the top reasons small businesses struggle in their early years. This is why financial planning for small business owners is not optional. It is a core business skill. When done right, it helps you stay profitable, reduce stress, and make confident decisions even during slow periods.

In this guide, we break down five simple, but powerful financial planning tips based on real data and proven practices. These are practical steps you can apply without using complex tools or financial jargon.

Source: manlyfs.com.au

1. Build a Cash Flow Plan That Looks Ahead, Not Just Back

Cash flow is the lifeline of any small business. Research from JPMorgan Chase shows that nearly two third of small businesses face cash flow issues every year. Many profitable businesses still struggle because cash comes in later than expenses go out.

A solid cash flow plan starts with tracking when money actually moves, not just when invoices are sent or bills are recorded. You should know:

- How much cash you expect to receive each month

- When major expenses are due

- Which months tend to be slow or strong

This forward view is a key part of financial planning for small business owners because it helps you avoid surprises. Instead of reacting to shortfalls, you can prepare for them.

Experts recommend a rolling 3 to 6 month cash forecast. Update it monthly using real numbers. This simple habit improves decision making around hiring, inventory, and marketing spend.

Cash flow planning is also a core element of small business financial planning because lenders and investors often look at cash stability before approving funding.

2. Separate Business and Personal Money Completely

Many small business owners still mix personal and business finances, especially in the early stages. While this may feel convenient, research shows it leads to poor tracking, tax issues, and unclear profitability.

A study by the National Small Business Association found that businesses with separate accounts are far more likely to understand their true financial position. This separation is a basic but critical step in small business owner financial planning.

Here is what separating finances helps you achieve:

- Clear view of business income and expenses

- Easier tax preparation and fewer errors

- Better protection during audits or legal reviews

Open a dedicated business bank account and credit card. Pay yourself a set amount instead of pulling money randomly. This creates discipline and supports long-term financial planning for business owners who want stability, not guesswork.

Over time, this clarity also helps when you review profits, plan investments, or prepare for growth.

3. Plan for Taxes All Year, Not at the Deadline

Taxes are one of the biggest financial stress points for business owners. The problem is rarely the tax bill itself. It is the lack of planning.

IRS data shows that many small businesses underpay estimated taxes, leading to penalties and cash strain. Proper financial planning for small business owners includes setting aside money for taxes every month, not just during tax season.

Smart tax planning involves:

- Estimating quarterly tax payments based on current income

- Setting aside a fixed percentage of revenue

- Tracking deductible expenses consistently

This approach turns taxes into a predictable expense instead of an emergency. It also helps you take advantage of deductions legally and avoid last-minute decisions.

Good tax planning is a major part of financial planning for small businesses because it protects cash flow and supports compliance at the same time.

4. Create a Simple Profit Plan, Not Just a Revenue Goal

Many business owners focus heavily on revenue. But revenue alone does not pay the bills. Profit does.

Research from SCORE shows that small businesses with clear profit targets are more likely to survive beyond five years. This is why profit planning is essential in financial planning for small business owners.

A profit plan answers three simple questions:

- How much profit do you want to make this year

- What expenses are necessary to support that goal

- What needs to change if profit falls short

You do not need complex models. Start with your target income, add fixed and variable costs, and work backward to pricing and sales goals. This approach supports small business owner financial planning by linking daily decisions to long-term outcomes. It also makes it easier to spot overspending early.

Having a profit plan is one of the most practical forms of financial advice for business owners because it shifts focus from working harder to working smarter.

5. Review Your Numbers Monthly and Adjust Fast

One of the most overlooked habits in financial planning for small business owners is regular review. Many owners only look at their numbers when something feels wrong.

Data from QuickBooks surveys shows that businesses that review financial reports monthly are more confident and better prepared for downturns. Monthly reviews help you:

- Catch cash flow issues early

- Adjust pricing or expenses quickly

- Measure progress toward goals

Focus on a few key reports:

- Profit and loss statement

- Cash flow summary

- Expense trends

You do not need to analyze every detail. Look for changes, patterns, and gaps. This habit strengthens financial planning for business owners because it turns numbers into action.

Consistent reviews also provide reliable financial advice for small business owners in real time, based on your own data instead of assumptions.

Why Simple Financial Planning Works Better Than Complex Systems

Many small businesses avoid planning because they think it requires advanced tools or financial expertise. Research shows the opposite. Simple systems that are used consistently outperform complex systems that are ignored.

Effective financial planning for small business owners is about habits, not spreadsheets. When you understand your cash flow, plan for taxes, protect profit, and review numbers regularly, you build resilience.

This approach also supports long-term financial planning for small businesses because it adapts as your business grows. What matters most is clarity and consistency.

Strong Financial Planning Builds Confident Business Owners

Every small business owner wants stability, growth, and peace of mind. That starts with clear financial habits. The five tips covered here are simple, but they are backed by real data and proven results.

When you focus on cash flow, separate finances, plan for taxes, protect profit, and review numbers regularly, financial planning for small business owners becomes a practical tool, not a stressful task.

These steps also support smarter financial planning for business owners, better decision making, and long-term sustainability. If you apply them consistently, you will gain clarity, control, and confidence in your business finances.

If you want expert support to put these strategies into action, we recommend working with Monily. We help small business owners build clear, reliable financial systems so they can focus on growth instead of stress.

Book a consultation with us to get started with smarter planning today.

Farwah Jafri

Farwah Jafri is a financial management expert and Product Owner at Monily, where she leads financial services for small and medium businesses. With over a decade of experience, including a directorial role at Arthur Lawrence UK Ltd., she specializes in bookkeeping, payroll, and financial analytics. Farwah holds an MBA from Alliance Manchester Business School and a BS in Computer Software Engineering. Based in Houston, Texas, she is dedicated to helping businesses better their financial operations.