Bookkeeping for E-commerce: A Detailed Guide

What is a Safe Note: Things You Should Know

April 29, 2024

Overcoming Challenges with QuickBooks Integration in E-commerce

May 9, 2024Bookkeeping for E-commerce: A Detailed Guide

Everyone loves seeing that profit climb each year, but no one really likes to spend hours deep diving into all their entries from last year. As e-commerce enthusiasts, we love to wear multiple hats, but bookkeeping may be one that just won’t fit! However, that doesn’t mean efficient bookkeeping for e-commerce isn’t valuable.

Love to put those products up for sale on Shopify? Here are some statistics from your favorite e-commerce platform that might shock you!

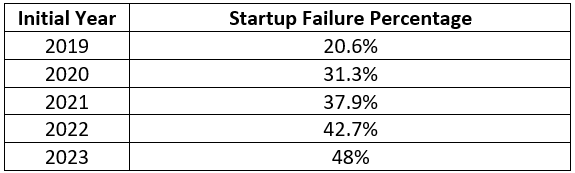

It is important to note that only about half of the businesses that started in 2018 survived the half decade mark. This is when most of those businesses that failed should have started reaping profits. Where did they lag?

Research suggests most startups fail in the initial years due to a lack of capital. In fact, a survey noted that amongst the reasons founders linked to the failure of their startups, 38% noted that running out of money was the most important one!

Here are 3 tips to help you keep those finances in control in the first year;

1. Keep That Burn Rate in Check

In simple terms, burn rate is the amount of cash you burn each month which your startup eventually consumes. Think of your startup like a living breathing organism with unending hunger in the first two to three years of your operation.

Fixed costs like rent, utilities, and salaries may be unavoidable. But you can get creative with variable costs. Set a budget or a boundary and aim never to cross it. Use your books to keep track of whether you are staying in line. This can only be possible if you track your entries, which can get quite difficult real fast. Luckily, accounting software can help you do this much faster, more accurately, and with less hassle.

2. Keep an Eye on the Cash Flow

Your cash inflows and outflows will determine the trajectory your startup will take in terms of its growth and finances. In fact, it often creates a blueprint for the years to come. With a good amount of cash inflow that exceeds, or at the very least matches your cash outflows, you get a greater ability to pay off the fixed costs as well as invest in innovation.

In order to avoid running out of cash it is important to keep a track of your loan payments as well as the amount of money that is caught in the pipeline (receivables). You must ensure you choose the right suppliers, bill your customers in time, and keep that investment flowing in the first year.

3. Map Out that Runway

This simply means that you need to create all your business plans keeping your current cash balance in mind. A runway is the amount of time your business can survive on your current cash flow, so if you want to take expensive business decisions that eat away at it fast, make sure you keep a game plan ready that brings back that cash for you before you run out of it!

Bookkeeping for E-commerce: The Dos, Don’ts, and Everything in Between

Let’s dissect what bookkeeping for e-commerce really is. In simple terms, it involves tracking all your financial transactions (both inflows and outflows) and keeping a record of them throughout the year, be it digitally or in a physical ledger. For e-commerce, this can get pretty complicated fast!

Accounting for e-commerce business matters includes tracking financial transactions that are linked to your sales, expenses, taxes, inventory inflows and outflows, receivables, marketing and advertisement, and so on. In actuality, it is an endless process with different e-commerce businesses utilizing entirely unique ways to track their growth.

An e-commerce accountant is valuable in this instance. This is because e-commerce accountant possesses that unique industry knowledge that allows them to identify the accounting methods and software as well as financial ratios that are best for your unique niche. This increases your chances of success as an e-commerce startup.

Accounting for E-commerce Business: Popular Methods

Here are some popular ways e-commerce businesses usually do their accounting;

1. Cash-Basis Accounting

Bookkeeping for e-commerce will usually rely on the traditional cash-based accounting in the initial months which is strictly reliant on the actual cash flow. In layman terms, you’d just be concerned with the sales and expenses at this stage, keeping a strict check of how much cash flows out of your business compared to the amount of cash you have.

Cash inflows are only ever recorded once they enter your accounts. So although you may be making a lot of deals, your accountant may not record it till it is realized.

2. Accrual Accounting

Accrual accounting relies on recording transactions as they occur. So as soon as you make that deal, whether the customer pays in credit or not, your transaction would be recorded. This may give you an accurate picture of whether you are making sales or not. In fact, it is much more detailed than the first option.

The accounting method you choose will depend entirely on your goals as well as where you are in your business lifecycle. There is no one better than an accountant who can guide you through this smoothly.

5 Tips to Note When Bookkeeping for E-commerce

Here’s what you have been waiting for all along; 5 tips that can help you make bookkeeping for your e-commerce business a success!

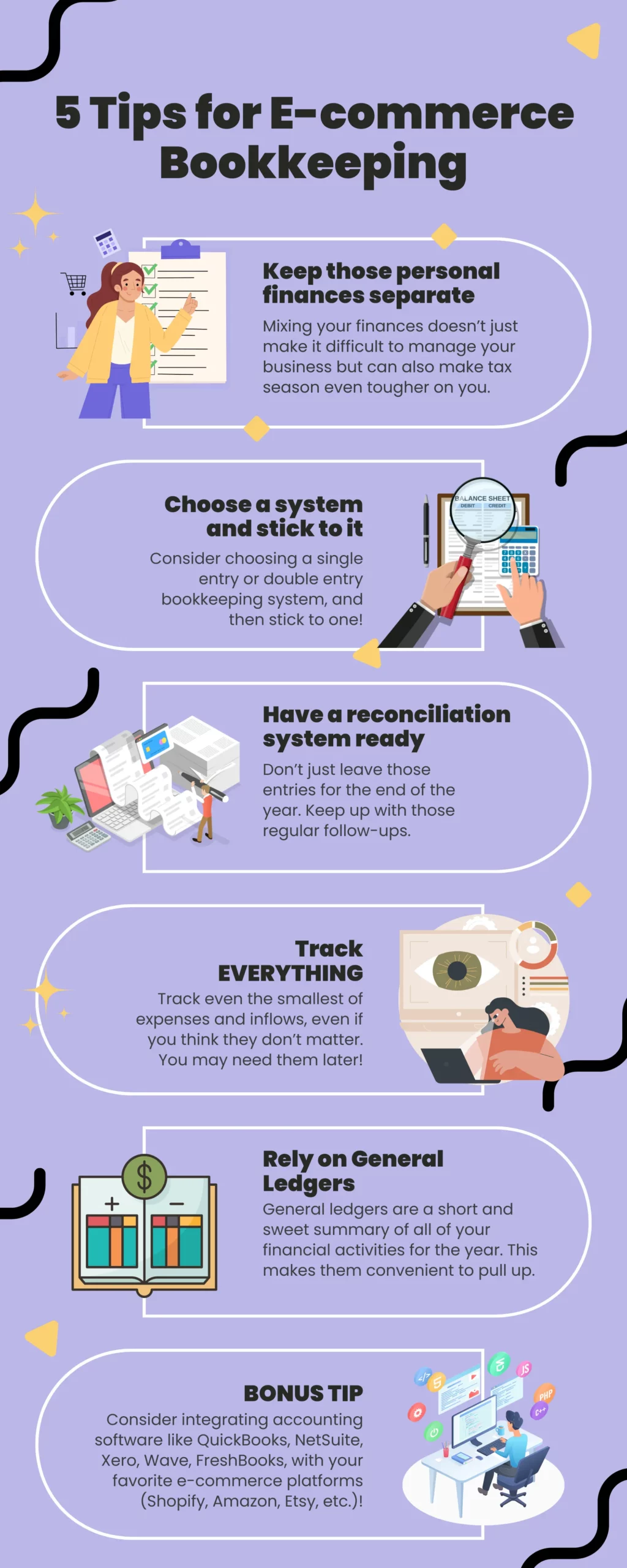

1. Keep Those Personal Finances Separate

One of the best tips we can offer you is to keep those personal finances separate from your business expenditure. Mixing your finances doesn’t just make it difficult to manage your business but can also make tax season even tougher on you.

With a separate business account, you can easily monitor those expenses, create accurate financial reports, and identify tax deductibles that apply to your business.

2. Choose a System and Stick to it!

When choosing an accounting method for your e-commerce business, pick one and stick to it. You may choose to record your transactions as single entries or double entries. Although double entry bookkeeping allows you to double check whether your income, expenses, assets, and liabilities line up, it isn’t really the only proven method for success. All you need to focus on is consistently following one till the end.

3. Have a Reconciliation System Ready!

Listen up because this is important! Don’t just leave those entries for the end of the year or quarter as you are going to end up with a mountain that you most certainly won’t be able to handle! Bookkeeping for any business is easier when you follow up regularly. Keep your monthly records in check and reconcile them from time to time. Set up daily, weekly, or monthly reminders (or all of the above)!

The next step should ideally be to produce financial reports every month and quarter to analyze whether your business performance is up to the mark! This will ensure you nip any rising issues in the bud before they turn into a disease that eats away at your startup.

4. Track EVERYTHING!

Track even the smallest of expenses and inflows, even if you think they don’t matter. Since you are in the early stages of your business, you never know what you may need around tax season or later on in the business cycle.

So those sunglasses you bought on the company’s tab during that business trip or the lunch with a potential client is going to stab you in the back during tax season, if you let it! Keep those receipts handy and note down the nature of all expenses so that it is much easier for you to differentiate once tax season comes along!

5. Rely on General Ledgers

General ledgers are a short and sweet summary of all of your financial activities for the year. This makes it much more convenient to find anything specific you are looking for without having to pull up all your past business transactions. You can also divide up your ledger into separate sections to make your life easy.

BONUS TIP

All this and more can be achieved much more smoothly, and without much hassle, through accounting software like QuickBooks, NetSuite, Xero, Wave, FreshBooks, and many more that can also easily integrate with all your favorite e-commerce platforms (Shopify, Amazon, Etsy, etc.) so it may be time to consider transferring your books to the cloud!

Bottom Line

If you want to keep an eye on that bottom line, you need to pull up your socks at the start of the business cycle. No more letting go of those books! It is time to push beyond your comfort zone and rely on out-pf-the-box methods that give you more accurate records and financial reports.

Monily can help! We can support your e-commerce empire by cleaning up your records and helping you shift to cloud-based accounting tools. You don’t need to take our word for it. Book a free consultation today and speak to our accountants so you can get comfortable before making that final decision!

Wajiha Danish

Wajiha Danish is the Director at Monily, overseeing financial strategies and operations for small and medium businesses. She has over 18 years of experience, including her role as Controller at HOCHTIEF PPP Solutions North America. Wajiha's background includes significant roles at Pakistan Petroleum Limited and A.F. Ferguson & Co. (PwC Pakistan). She is a Chartered Certified Accountant (ACCA) and Certified General Accountant (CGA) with expertise in financial management and project finance.