How To Reduce Your Tax Bill! 10 Tips for Small Business Owners

ASC 606 Revenue Recognition Explained for SaaS Companies

January 27, 2026

SaaS Subscription Accounting Best Practices

January 30, 2026How To Reduce Your Tax Bill! 10 Tips for Small Business Owners

Running a small business means every dollar matters. You work hard to earn revenue, manage expenses, and grow steadily, yet tax time often feels like money is slipping away without much you can do about it.

And the truth is that many business owners overpay because they do not know what they are allowed to deduct, how to plan taxes better, or how to structure differently.

But here’s another important fact. The tax system already includes many legal ways for small business owners to lower their tax bills. You just need to know where to look and how to apply them correctly.

Frankly, knowing how to reduce business taxes isn’t about shortcuts or risky moves. It’s just about using the rules as they were written.

In this blog, we will tell you 10 practical and research-backed tips that show small business owners how to keep more of what they earn. Everything in this blog is based on standard tax principles used by bookkeepers and accountants everywhere, every day.

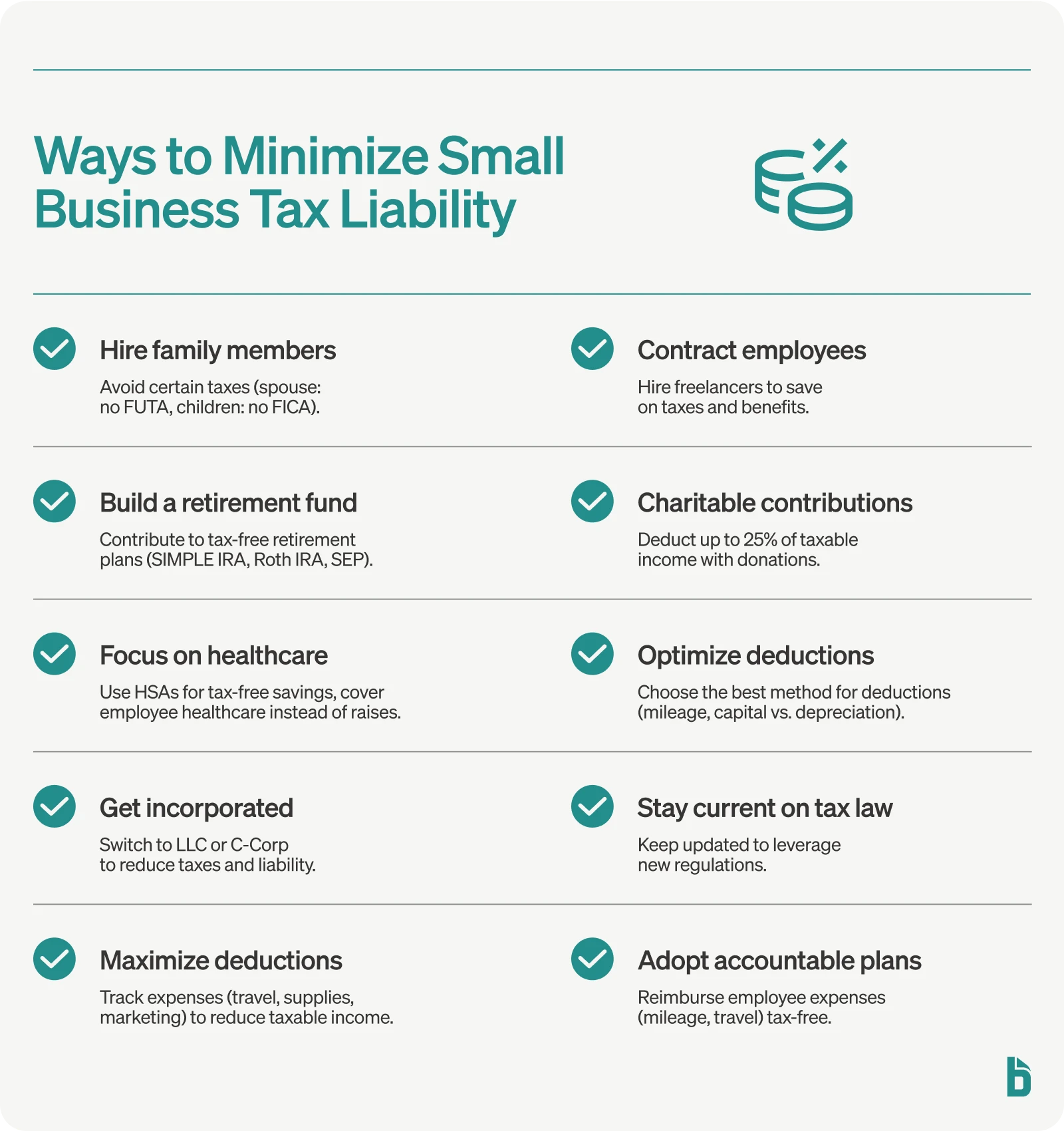

Source: bill.com

1. Choose the Right Business Structure

Your business structure plays a major role in how tax you pay. Sole proprietors, partnerships, LLCs, and corporations are all taxed differently.

For example, sole proprietors pay income tax and self-employment tax on all profits. An LLC taxed as an S corporation may allow you to split income between salary and distributions, which can lower self-employment taxes. C corporations pay corporate tax but may benefit from flat tax rates and deductible benefits too.

According to the IRS, many small businesses default to a structure without reviewing its long-term tax impact. Reviewing your structure regularly is one of the smartest ways to figure out how to reduce business taxes as your income grows.

2. Track Every Business Expense Carefully

According to the IRS audit data, businesses that keep detailed records are far less likely to miss deductions or face penalties. However, missing deductions is also one of the most common reasons small business owners overpay taxes.

Deductible expenses often include:

- Office rent and utilities

- Software and subscriptions

- Marketing and advertising

- Insurance

- Professional fees

- Internet and phone costs

Good recordkeeping is not optional. It directly allows you to pay less taxes as a business owner. Remember, every legitimate expense reduces taxable profit, which in return lowers your tax bill.

3. Use the Home Office Deduction Correctly

If you work from home, the home office deduction can give you some real advantage. This applies only if the space is used regularly and only for business.

You can deduct a portion of:

- Rent or mortgage interest

- Property taxes

- Utilities

- Home insurance

- Repairs related to the office

Studies show many business owners skip this deduction out of fear, yet when calculated correctly, it’s completely allowed and legal. This is one of the most overlooked tax benefits for small business owners who operate remotely.

4. Understand Depreciation and Asset Write-Offs

When you buy equipment, furniture, or machinery, you may not need to deduct the cost over many years. Section 179 and bonus depreciation rules often allow you to deduct most or all of the cost in the year of purchase. Thus, reducing your tax bill for the said year.

This includes:

- Computers and laptops

- Office furniture

- Business vehicles

- Machinery and tools

Using depreciation wisely improves cash flow and helps you understand how do business owners pay less taxes while still investing in growth.

5. Take Advantage of Retirement Contributions

Small business owners can reduce taxable income by contributing to retirement plans. Options include SEP IRAs, Solo 401(k), and Simple IRAs.

Contributions are often tax-deductible, which lowers your current tax bill while also helping you save for the future. Research shows that business owners who use retirement plans strategically actually know how to reduce business taxes and do save thousands of dollars each year.

This is also a strong example of long-term tax benefits of owning a small business.

6. Hire Family Members The Right Way

Hiring your spouse or children can also offer tax savings if done correctly. Wages must be paid reasonably and real work must involve.

In some cases:

- Payments to children may avoid certain payroll taxes

- Income shifts to lower tax brackets

- Wages become deductible business expenses

This strategy is widely used and supported by US tax law, but documentation always matters. It’s another practical way you should consider while thinking about how to reduce business taxes and supporting your household.

7. Claim Health Insurance and Medical Deductions

Health insurance premiums are often deductible for self-employed individuals. This includes coverage for yourself, your spouse, and dependents.

You may also deduct:

- Health savings account contributions

- Certain medical expenses through approved plans

Healthcare costs continue to rise, and the tax benefits for small business help offset that burden when applied correctly.

8. Time Income and Expenses Strategically

Cash-based businesses can delay invoicing or accelerate expenses near year-end to reduce taxable income. This strategic timing of income and expenses can impact your tax bill significantly.

This approach is commonly used by accountants and supported by IRS accounting rules. So, if you’re wondering “how to pay less taxes as a business owner?” the answer lies in planning ahead for upcoming expenses and invoices. This helps you reduce taxes without changing how much you earn overall.

9. Use Available Tax Credits

Tax credits reduce taxes dollar for dollar, making them more powerful than deductions. small business owners may qualify for credits related to:

- Research and development (R&D credits)

- Energy efficiency

- Hiring employees from certain backgrounds

- Health coverage

Many eligible businesses never claim these credits due to lack of awareness. However, credits can be termed as one of the biggest tax benefits of owning a small business.

10. Work with Professionals Who Focus on Small Business Taxes

Tax laws change often, and small details if missed, can have big impacts. Research also consistently shows that businesses working with professional bookkeepers and tax advisors pay less taxes over time compared to those who handle everything alone.

A professional helps ensure:

- Accuracy in records

- Full use of deductions

- Compliance with tax laws

- Long-term tax planning

This support is essential for business owners serious about learning how to reduce business taxes year after year.

How to Reduce Business Taxes with Consistent Planning

Lowering your tax bill is not a one-time task. It’s an ongoing process that combines good records, smart decisions, and proper planning. When you understand all your options, taxes become manageable instead of stressful.

The tax benefits for small business owners exist to support growth, investment, and stability. Using them correctly also allows you to keep more profit and reinvest in your business growth.

So, if you are asking how do business owners pay less taxes, the answer is clear. They plan early, track carefully, and get expert support.

Reduce Business Taxes and Stress with Us

Learning how to reduce business taxes is one of the most important skills for any small business owner. From deductions and credits to planning and structure, every move adds up.

When you understand the tax benefits of owning a small business and apply them correctly, you gain control over your finances and your business future. And remember, smart tax planning isn’t about avoiding taxes. Instead, you prioritize tax planning so you can actually pay what you truly owe, nothing less, nothing more.

If you also want expert help applying the strategies discussed above, connect with us at Monily. Our team specializes in helping small business owners stay compliant while also paying less tax legally.

Farwah Jafri

Farwah Jafri is a financial management expert and Product Owner at Monily, where she leads financial services for small and medium businesses. With over a decade of experience, including a directorial role at Arthur Lawrence UK Ltd., she specializes in bookkeeping, payroll, and financial analytics. Farwah holds an MBA from Alliance Manchester Business School and a BS in Computer Software Engineering. Based in Houston, Texas, she is dedicated to helping businesses better their financial operations.