When to Hire an Interim CFO for Your Startup?

What is Catch Up Bookkeeping? Here’s All You Need to Know!

July 12, 2024

A Detailed Guide to Shopify Bookkeeping: Best Practices for E-commerce Businesses

August 2, 2024When to Hire an Interim CFO for Your Startup?

Startups are popping up everywhere nowadays. That doesn’t mean all of them will turn out to be successful. As startups grow, managing a business and its finances becomes more challenging than when they were small businesses. When to hire interim CFO for startups? This is exactly the situation where it is needed.

A growing business would eventually require a lot more expertise than a founder or smaller team can bring to the table. Hiring an interim CFO can be a game-changer. An interim CFO brings the financial knowledge and strategic insight needed to guide your startup through critical growth periods, without the added long-term commitment of a full-time hire.

So, when should a startup hire a CFO? The following sections explore what an interim CFO does, when your startup should hire a CFO, the qualities you should look for in an interim CFO, and the many benefits they can introduce to your business!

What is an Interim CFO, and What Do They Do?

An interim CFO is a temporary financial executive who steps into the company to provide much-needed financial leadership and guidance during transitional periods or for specific projects. Unlike a full-time CFO, an interim CFO is typically brought in for a set duration, ranging from a couple of months to a few years, depending on the company’s needs.

The primary role of an interim CFO is, first and foremost, to offer strategic financial guidance, and subsequently, to improve financial processes and ensure the company is performing at peak financial health.

Why Hire Interim CFO for Startups: Key Responsibilities of an Interim CFO

Here are some of the key responsibilities a typical interim CFO would shoulder when managing finances for a business;

- Financial Planning and Analysis: An interim CFO conducts thorough financial planning and analysis to help the company understand its financial position, forecast future performance, and make informed decisions.

- Cash Flow Management: Effective cash flow management is crucial for any startup. The interim CFO ensures that the company has enough liquidity to meet its obligations while planning for future growth.

- Budgeting and Forecasting: Creating and managing budgets is a core function of an interim CFO. They develop realistic budgets that align with the company’s strategic goals and monitor performance against these budgets.

- Financial Reporting: Accurate and timely financial reporting is essential for transparency and compliance. An interim CFO oversees the preparation of financial statements and reports to provide a clear picture of the company’s financial health.

- Fundraising and Investor Relations: For startups seeking additional capital, an interim CFO plays a crucial role in fundraising efforts. They prepare financial models, pitch decks, and communicate with potential investors to secure funding.

- Risk Management: Identifying and mitigating financial risks is another key responsibility. The interim CFO assesses the company’s risk exposure and implements strategies to minimize these risks.

- Strategic Financial Advice: Beyond day-to-day financial management, an interim CFO provides strategic advice on mergers and acquisitions, business expansions, and other critical decisions.

When Should a Startup Hire a CFO?

Determining when to hire interim CFO for startups is a big responsibility. Even greater is the burden of ensuring that CFO is right for the startup. The right kind of financial oversight can allow your business to grow while the wrong financial advice can make it sink. Here are some indications you should keep in mind when wondering if it’s time to hire an interim CFO;

1. Rapid Growth

Has your startup recently experienced rapid growth? That might be a great sign to bring on board an interim CFO. This financial advisor can make it easy for you to scale your financial operations, manage cash flow as the size of your business increases, and provide you insights that keep the growth consistent.

2. Preparing for Fundraising

Are you preparing for a fundraising round? If you answered yes to that question, it is important to have a clear and compelling financial narrative. An interim CFO can craft detailed financial models, prepare pitch decks, and communicate effectively with potential investors, increasing your chances of securing capital.

3. Financial Complexity

As your startup grows, financial complexity increases. Managing multiple revenue streams, tracking expenses, and ensuring compliance with financial regulations can become overwhelming. An interim CFO can streamline these processes and ensure accurate financial reporting.

4. Need for Strategic Financial Guidance

Startups often face critical decisions that require strategic financial guidance. Whether it’s evaluating a potential merger, considering an acquisition, or planning for international expansion, an interim CFO can provide the necessary expertise to make informed decisions.

5. Cash Flow Issues

Cash flow problems are a common challenge for startups. If you’re struggling to manage cash flow, pay suppliers, or meet payroll, an interim CFO can implement effective cash flow management strategies to stabilize your financial position.

6. Succession Planning

If your current CFO is leaving or you’re transitioning from a founder-led financial strategy, hiring an interim CFO can provide continuity and stability during the transition period. This ensures that financial operations remain smooth and strategic goals are met.

What Are Some Qualities You Should Look for in an Interim CFO?

Selecting the right interim CFO can make or break your business. Here are some key qualities an interim CFO must have;

A. Financial Expertise and Experience

The primary reason backing the decision to hire interim CFO for startups is their financial knowhow. Look for candidates with wide experience in financial management, particularly within your industry. They should have a strong past performance that indicates successful management of financial operations and providing strategic financial guidance.

B. Strategic Vision

An active interim CFO should have a strategic vision that aligns with your company’s goals. They should be able to see the big picture, identify growth opportunities, and develop strategies to capitalize on these opportunities. Their ability to think strategically and provide long-term financial planning is central to the success of your startup.

C. Invaluable Analytical Skills

Analyzing financial data and deriving actionable insights is a core function of an interim CFO. They should possess strong analytical skills to assess your company’s financial health, identify trends, and provide data-driven recommendations. This analytical dexterity ensures that your financial decisions are well-informed and based on solid data.

D. Excellent Communication Skills

An interim CFO needs to communicate effectively with various stakeholders, including the executive team, board members, investors, and employees. They should be able to present complex financial information clearly, facilitating informed decision-making across the organization.

E. Adaptability and Flexibility

Startups operate in an environment where one must be on their feet at all times. Thus, an interim CFO should be adaptable and flexible, capable of adjusting to changing circumstances and priorities. Their ability to quickly understand your business and integrate into your team is crucial for providing efficient financial leadership.

F. Problem-Solving Ability

Financial challenges are inevitable in any business. An effective interim CFO should have strong problem-solving skills to address these challenges head-on. Whether it’s resolving cash flow issues, managing financial risks, or optimizing expenses, their ability to find solutions is critical for your startup’s success.

G. Leadership and Team Management

An interim CFO often leads the finance team and collaborates with other departments. Strong leadership and team management skills are essential for fostering a collaborative and productive work environment. They should be able to inspire and motivate their team, ensuring that financial goals are met.

H. Integrity and Reliability

Trustworthiness and reliability are fundamental qualities for any financial leader. An interim CFO must operate with the highest level of integrity, ensuring that financial practices are ethical and compliant with regulations. Their reliability and commitment to transparency build trust within the organization.

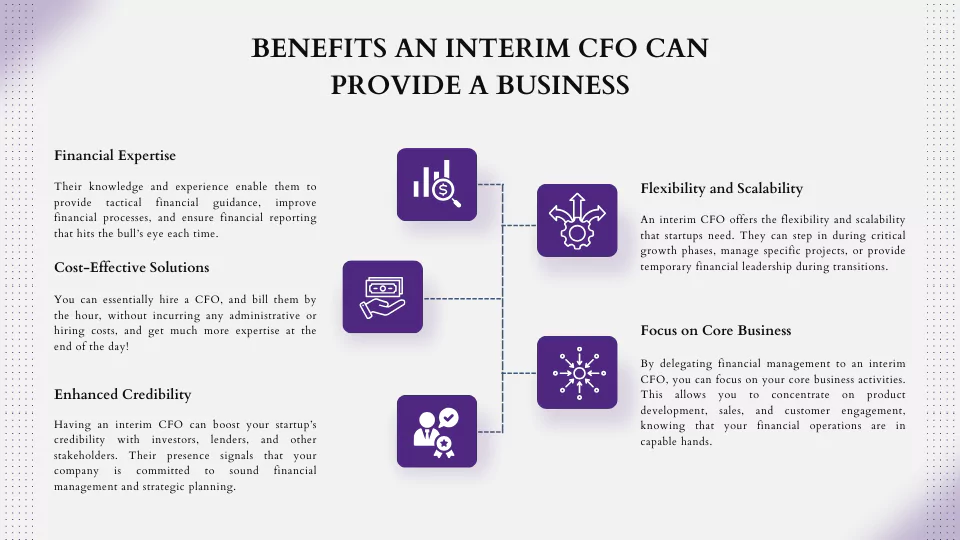

Benefits An Interim CFO Can Provide a Business

Deciding to hire interim CFO for startups offers several benefits that can drastically impact your business’s success:

1. Financial Expertise

An interim CFO introduces quite a bit of financial expertise to your startup. Their knowledge and experience enable them to provide tactical financial guidance, improve financial processes, and ensure financial reporting that hits the bull’s eye each time.

This expertise is instrumental for directing your business through the complications that often accompany growth. Often, it is the driving force that catapults your business towards long-term success.

2. Cost-Effective Solutions

Hiring a full-time CFO can be expensive, especially for startups with limited budgets. An interim CFO provides a cost-effective solution, offering the same level of expertise without the long-term commitment.

This gives you access to high-level financial leadership at a fraction of the cost. You can essentially hire a CFO, and bill them by the hour, without incurring any administrative or hiring costs, and get much more expertise at the end of the day!

3. Enhanced Credibility

We all know that a CFO can add accuracy to your financial forecasts. But here is a benefit you might not have expected!

Having an interim CFO can boost your startup’s credibility with investors, lenders, and other stakeholders. Their presence signals that your company is committed to sound financial management and strategic planning.

This can definitely increase your chances of securing funding and building strong relationships with key stakeholders!

4. Flexibility and Scalability

An interim CFO offers the flexibility and scalability that startups need. They can step in during critical growth phases, manage specific projects, or provide temporary financial leadership during transitions.

This type of flexibility and ready support allows your business to comfortably mold itself to changing needs and scale your financial operations as required.

5. Focus on Core Business

By delegating financial management to an interim CFO, you can focus on your core business activities. This allows you to concentrate on product development, sales, and customer engagement, knowing that your financial operations are in capable hands.

FAQs

What is an interim CFO?

An interim CFO is any financial executive who has been hired to provide financial leadership and advice to your company during a limited period. That period could be as short as an hour, and as long as a couple of years as it depends entirely on you and your business needs.

When should one hire interim CFO for startups?

When should a startup hire a CFO? The answer varies from business to business, according to their needs.

Startups should consider hiring an interim CFO during rapid growth cycles when they feel their company’s finances are getting too much to handle for them or their in-house team alone, or if they feel they cannot bear the cost of a full-time CFO.

What are the benefits of hiring an interim CFO?

Hiring an interim CFO allows you to enjoy all the services an in-house CFO would provide, at half the cost. You also get much more accuracy when it comes to financial forecasts, as well as a plethora of other types of assistance such as integration with accounting tools and platforms, which seems to be the number one priority for CFOs in 2024.

What does an interim CFO do?

An interim CFO handles financial planning and analysis, cash flow management, budgeting, financial reporting, fundraising, risk management, and provides strategic advice.

Final Thoughts

Hiring an interim CFO for startups is quite often a strategic move that considerably impacts your business’s success. An interim CFO provides the financial expertise, strategic insights, and improved financial management that startups need to navigate growth and achieve their goals.

It is essential to be able to recognize when your startup should hire a CFO. It could occur to you during rapid growth, when preparing for fundraising, or while going head-on with a certain financial difficulty. The decision you make when hiring that CFO is crucial for ensuring the right financial oversight is in place.

When selecting an interim CFO, look for qualities such as financial expertise, strategic vision, strong analytical skills, excellent communication, adaptability, problem-solving ability, leadership, and integrity. These qualities ensure that your interim CFO can effectively lead your financial operations and provide valuable insights.

Your choice of an interim CFO could be a game-changer. Make sure you make the right decision! Lean on Monily’s fractional CFOs and cut that cost in half while ensuring you get the right financial advice every time!

Wajiha Danish

Wajiha Danish is the Director at Monily, overseeing financial strategies and operations for small and medium businesses. She has over 18 years of experience, including her role as Controller at HOCHTIEF PPP Solutions North America. Wajiha's background includes significant roles at Pakistan Petroleum Limited and A.F. Ferguson & Co. (PwC Pakistan). She is a Chartered Certified Accountant (ACCA) and Certified General Accountant (CGA) with expertise in financial management and project finance.