Overcoming Challenges with QuickBooks Integration in E-commerce

Bookkeeping for E-commerce: A Detailed Guide

May 5, 2024

What is a Suspense Account: Definitions | Examples | Purpose

May 16, 2024Overcoming Challenges with QuickBooks Integration in E-commerce

E-commerce has lasted the test of time indeed. It is continuing to change the way businesses operate, offering solutions that couldn’t be accessed years ago. However, regardless of the ease that e-commerce platforms provide, their financial management can be equally difficult. Even well-known platforms such as QuickBooks for e-commerce business can often lead to issues that are difficult to resolve without a trained eye.

What if we told you that you don’t really need that trained eye after all? The following sections explore some of the common problems e-commerce businesses may face when using QuickBooks, and some solutions that may work!

E-commerce QuickBooks integration can be hard. That doesn’t mean it’s impossible!

Introduction to QuickBooks for E-commerce

So, what’s QuickBooks really about? Is it really useful when it comes to your e-commerce business?

QuickBooks online allows you to have all the financial tools you need in one place. You can integrate with all your favorite e-commerce apps you need to manage your business without having to give up on the control over your finances.

No matter the business, it can be difficult to manage both the sales and the accounting. The daily bookkeeping alone at the start of the business can quickly become a headache you just don’t want to handle.

This is where QuickBooks comes in, stepping in as a trusted software that can help you automate your inventory and books so you have more time for important business decisions. In fact, around 13% of small businesses report using QuickBooks to save time. However, that doesn’t mean you won’t encounter a hiccup or two during e-commerce QuickBooks integration!

QuickBooks for E-commerce: 3 Issues You May Face

QuickBooks may offer amazing tools to help you manage your e-commerce empire, but that doesn’t mean those tools are the only thing you will need to guide you through your journey. Let’s proceed to five of the most popular challenges people report during e-commerce QuickBooks integration!

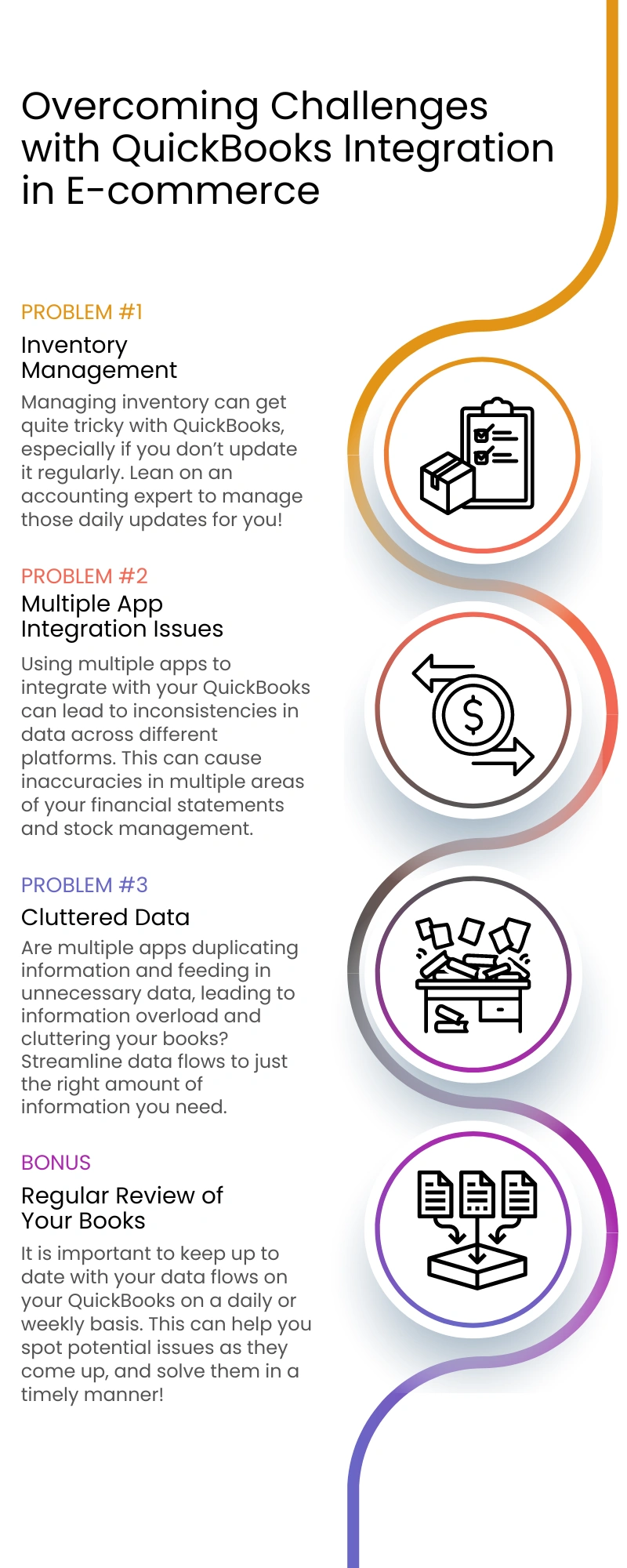

1. Inventory Management: When New Items Become a Nightmare

Growing should be something to celebrate, right? Well, growing is only ever good when it is manageable. Often, managing inventory can get much more complicated with software like QuickBooks for ecommerce business, if you jump in without learning all about it.

E-commerce businesses involve quite a lot of product movement, especially at the start when you are learning the ropes and trying to understand which products work, and which do not.

Not all products are alike, and each of the items in your inventory have different attributes, which is why they are also priced differently. However, if you do not assign them unique codes, and ensure you keep QuickBooks updated, you may face issues such as duplicate products or products with different sizes being priced at the same rate.

This doesn’t really achieve the efficiency and sales growth you are aiming for since your records might show much more inventory than you really have! It could create issues down the line, when you are trying to create financial models.

Spotlight

Cheri is a small business owner. She is running a cute little shop that offers handmade jewelry, crocheted items, as well as resin art. She gets an order from a regular customer for two resin coasters. However, she checks her inventory and notices the inventory status shows -3. Confused, she asks the customer to hold off on the order as she just can’t supply it yet.

Later, she walks into her workstation and finds five coasters in her stock. She opens up her inventory status and notices those coasters have been entered under an entirely different code.

Solution

This situation can happen to anyone. In fact, inventory management is one of the hardest things to master when running an e-commerce business with so many products coming in and going out.

The best way to avoid such errors is to ensure you assign the right codes to all items. This means identifying differently sized items and assigning certain codes to them that allows the software to tell them apart. It also means regularly checking and updating the software, or perhaps integrating it with an inventory management system that can help you track this without much hassle.

Still confused? Give us a call! Monily’s accountants know all about the issues that may arise with improper inventory management and tracking and can help you fix all that in a jiffy. We can also help you integrate with tools you think would help you manage your business best!

2. Integrating Multiple Apps: Mastering the Art of Juggling

E-commerce often means having to deal with customers who want to pay through entirely different and unique channels. For example, a customer may want to buy through Amazon, but pay through PayPal, not their credit card. Your suppliers may also opt for different marketing channels to receive their payments.

When using QuickBooks for e-commerce to pull all this data, you may only be able to pull the data accurately from one source. So, while that data exists in several different systems, it is only being fetched from one. This can lead to gaps in the information you feed to QuickBooks.

Spotlight

Cheri finally managed to get her inventory in order and get that order out for her repeat customer. However, the customer preferred to buy it through Amazon this time, choosing their primary mode of payment as PayPal.

Once the transaction was done, Cheri hopped on over to QuickBooks to check whether it had updated the information. She found that while QuickBooks had recorded the transaction from PayPal and added it to the profit, it hadn’t really updated the inventory which was linked to Amazon.

Solution

Although this problem may pose significant issues for a business, it had an easy solution. The best way to ensure everything stays updated over time is to add accounting integration tools to your arsenal.

However, these can be difficult to manage and run on your own. If you want to have better insight into your financial health and avoid human error when recording all your transactions, you may need to share the burden with a fractional CFO or bookkeeper who can handle the daily entries for you.

3. Cluttered Data: Filtering for What Works Best

Often, it isn’t about the incorrect information entered on QuickBooks but the amount of unnecessary details that aren’t really needed. It is easy for companies to rely too much on QuickBooks and fail to organize their data, choosing what really needs to go on to the app.

It is essential to know which kinds of apps you want by your side when you are trying to grow your e-commerce business. Don’t just choose all the platforms you can find and try to integrate them with QuickBooks as that can create a mess real fast.

Instead, try speaking to an accountant who knows all about your business functions and can guide you towards the right kind of software as well as inventory management and sales tools that can help you benefit your e-commerce business instead of piling on the cost without much gain.

Moreover, it is also wise to avoid depending entirely on an accounting software. Although automation of your books is great, it is important to keep checking the data from time to time to account for any gaps or potential mistakes that can lead to big issues down the line.

Monily can help you clean up your records and go over your past transactions to organize them in a way that helps you utilize QuickBooks to its best potential. We can alleviate the stress that comes with daily tasks such as tracking sales and inventory levels. We can also assist you to develop a concise and easy to manage QuickBooks workflow for your e-commerce business.

Start Your Journey Today

Ready to step into the world of e-commerce and start growing your empire from the ground up today? Speak to one of our expert financial advisors and get all the tips you need on avoiding or solving issues related to QuickBooks for e-commerce.

We can also help you transition to an accounting software or integrate an existing once with your favorite platform, so you don’t have to. All you need to do is take that first leap.

Don’t take our word for it. We suggest you try it out for yourself. Book a free consultation and describe your business model as well as what sort of solutions you are looking for, and see for yourself how Monily can help your business!

Nida Bohunr

A highly skilled accounting professional at Monily, having extensive and diverse experience of working in US healthcare and agriculture industry. Nida is a CA finalist with expertise in Bookkeeping, Auditing, Bank Liaison, Tax Preparation, Accounts Payable, Accounts Receivable.