What Is Perpetuity? A Complete Guide

Deferral In Accounting Defined: What Is It & Why Use It?

February 2, 2023

How To Make Your Business Recession Proof In 2023

February 14, 2023What Is Perpetuity? A Complete Guide

A security or bond that pays dividends or returns ad infinitum is perpetuity. In the business world, the term helps businesses know their market value and acts as a guide for stakeholders and investors to assess investment opportunities on the fly.

Over time, perpetuities have faded from the limelight, and less than a handful of perfect examples exist today. Nevertheless, the concept is vital, and its impact on the business world remains.

This article will explore perpetuity in detail, including its definition, real-life examples, and formula.

What is Perpetuity?

A perpetuity is a form of annuity that lasts a lifetime and beyond. In plain words, a never-ending stream of similar returns or cash flows. The best way to decode the term is as a property rental agreement with no end, ensuring returns forever.

In the real world, that seldom happens, and all investments have a definite end. The majority get cashed in, as literally, nothing lasts forever. Yet still, the concept is worth a million dollars, as it helps businesses define their market value and tag their shares in a universally acceptable way.

How To Calculate Present Value?

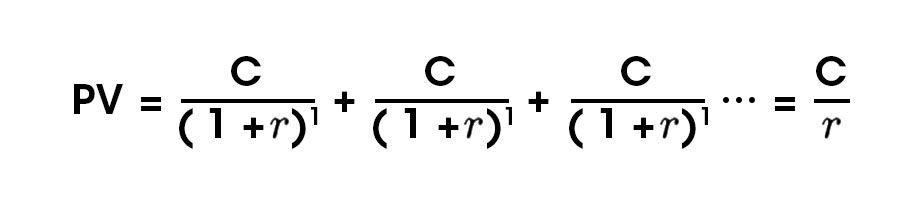

By definition, perpetuity is an annuity with no definite end. However, that doesn’t help much, as once you enter a value approaching infinity in a formula, the result becomes indefinite. Thus, businesses use a modified equation driven from the same concept to define the present value by projecting the stream of cash flows.

This formula gets you the present value or PV of your perpetuity by dividing the cash flow ‘C’ by the interest rate ‘r.’ Remember, this is a general formula and only factors the cash flow and yield or interest and ignores the impact of time value for money and money depreciation or appreciation.

Nonetheless, the formula is adequate to calculate the present value and assess your investment against other viable options. Using this formula, a business owner or an investor can check whether their investment is at par with the industry, above or below.

See Also: Deferral In Accounting Defined: What Is It & Why Use It?

Growing Perpetuity – Definition & Formula

The above formula works for fixed perpetuity but is inadequate to calculate the present value of a growing perpetuity or one with varying cash flows. In these, the returns appreciate by a substantial margin yearly.

A slight modification in the formula is required to calculate the present value of a growing perpetuity. The new one reads as follows:

Where,

– The first year cash flow refers to the first in the endless stream of cash flows.

– The interest rate signifies the rate of return.

– The growth rate indicates the rate at which the payments will grow.

Examples of Perpetuity

Perpetuity is a broad term and a pretty strange one. The reason? Its real-life examples are merely a handful. Yet still, there are some near-perfect ones to help clarify what perpetuity is.

– Home Investment

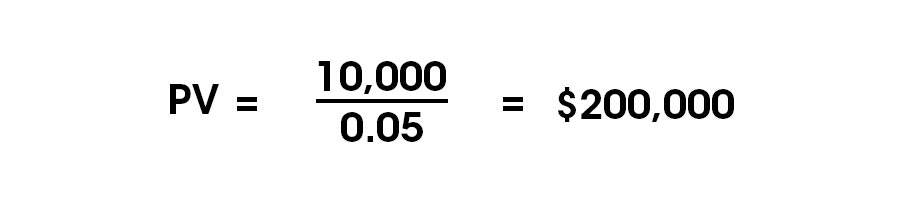

The best way to understand perpetuity is via a home investment example. Imagine you buy a rental property and rent it out for $10,000 per annum. By contract, you shall receive the rent annually till you sell it or the renter stops the rent. Thus, the income from this scenario is perpetuity — a fixed cash flow stream likely to continue forever.

Considering the annual interest or yield is 5%, the present value for the home would be:

– Stock Dividends

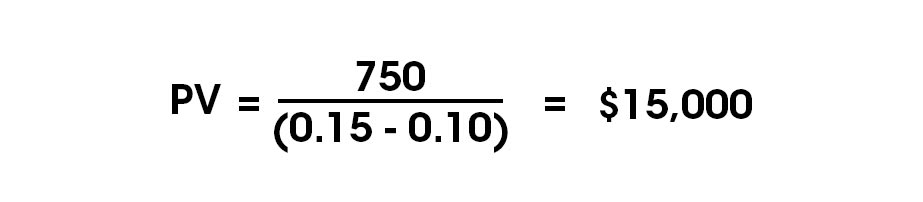

There exists no better way to understand growing perpetuity than through stock dividends. Imagine you buy stocks that pay $750 annually as a dividend. Given you hold the stock forever and the company continues to pay your dues, you can calculate the present value for the perpetuity by dividing the sum by yield minus growth. In this case, 15% and 10%, respectively.

Need Help Managing Perpetuity?

Managing perpetuity investments is no child’s play. There are no two ways about it, and as a busy business owner or investor, the daunting task may become near impossible. That’s why it is best to leave tricky affairs like perpetuity investment management to an expert financial analyst who knows their way around perpetuities.

Contact Monily expert accountants and analysts today and manage your finances like a pro. Remember, it is never too late to begin management. However, the best moment to do so is now, and the next best moment is the one that immediately follows.

Wajiha Danish

Wajiha Danish is the Director at Monily, overseeing financial strategies and operations for small and medium businesses. She has over 18 years of experience, including her role as Controller at HOCHTIEF PPP Solutions North America. Wajiha's background includes significant roles at Pakistan Petroleum Limited and A.F. Ferguson & Co. (PwC Pakistan). She is a Chartered Certified Accountant (ACCA) and Certified General Accountant (CGA) with expertise in financial management and project finance.