November 22 2024 | By Raza Agha | 8 minutes Read

What Is Double-Entry Accounting?

Why Was Double-Entry Accounting Invented?

Why Does Double-Entry Accounting Matter?

1. It Ensures Accuracy and Accountability

2. It Provides a Complete Financial Picture

3. It’s Essential for Financial Reporting

4. It’s Required for GAAP Compliance

The Building Blocks of Double-Entry Accounting

An Example of Double-Entry Accounting in Action

What Is Double-Entry Bookkeeping?

Advantages of Double-Entry Accounting

1. Error Detection and Prevention

2. Financial Insights

3. Transparency and Accountability

4. Scalability for Growing Businesses

5. Compliance and Audit Readiness

Common Challenges in Double-Entry Accounting and How to Overcome Them

1. Understanding Debits and Credits

2. Balancing the Books

3. Getting Started Without Expertise

4. Managing Complexity

5. Misclassification of Accounts

Why Modern Businesses Need Double-Entry Accounting

Wrapping Up: What’s Next for Your Business?

Every business, big or small, has one thing in common: the need to keep its finances in order. At the heart of this financial organization lies the most trusted system of bookkeeping—double-entry accounting.

Think of this system as the pillar on which all accounting depends. It is precise, logical, and essential for solving any financial discrepancies that may arise in the future. But what is double-entry bookkeeping, and why does it play such a vital role in business operations?

In this blog, we’ll dive deep into the mechanics of double-entry accounting, explore why it’s the gold standard, and discover how it simplifies complex financial processes. Whether you’re a business owner, an accounting enthusiast, or just someone curious about how businesses keep their finances straight, this post will make it all clear—and maybe even a little fun!

Let’s start with the basics. Double-entry accounting is a system where every financial transaction is recorded in at least two accounts. For every debit, there’s an equal and opposite credit. This ensures that your books always balance—no matter what.

For instance, if your business earns revenue, you would:

Similarly, if you buy office supplies, you would:

This pairing keeps the books balanced and ensures that every dollar has a clear path in and out of your financial system.

The history of double-entry accounting dates back to the 15th century when Italian mathematician Luca Pacioli—known as the “Father of Accounting”—introduced it to the world.

He didn’t invent it, but his writings in Summa de Arithmetica formalized the system. The method quickly became the cornerstone of financial management, helping merchants track profits and losses accurately.

Fast forward to today, and this system remains the backbone of modern accounting, proving its timeless relevance and utility.

Now that we’ve covered the basics, let’s address the million-dollar question: Why is double-entry accounting so important?

Picture this: You’re running a business, and a single transaction is recorded incorrectly. Without a system like double-entry, that error could go unnoticed, throwing your financial records into chaos. With double-entry accounting, errors are much easier to spot because your debits and credits must always match. If they don’t, it’s a clear signal that something’s amiss.

Unlike single-entry systems, which only track income and expenses, double-entry accounting tracks assets, liabilities, and equity. This holistic view helps businesses understand their financial position at any given time. Want to know if you have enough cash to cover a big expense or whether your debt is manageable? Double-entry has the answers.

If your business is ever audited, or if you need to prepare financial statements like the balance sheet and income statement, double-entry makes it a breeze. It ensures that all the data you need is already categorized and balanced, saving time and headaches.

For businesses aiming to grow, attract investors, or comply with accounting standards like GAAP (Generally Accepted Accounting Principles), double-entry bookkeeping is non-negotiable. It’s the foundation of accurate and compliant financial reporting.

At the heart of double-entry accounting lies the accounting equation:

Assets = Liabilities + Equity

This equation must always be in balance. To understand how it works, let’s break down its components:

Every transaction affects at least two of these components, ensuring that the equation stays balanced.

Let’s say your business takes out a $10,000 loan to purchase new equipment. Here’s how the transaction would look:

Later, when you use $8,000 of that cash to buy the equipment:

These entries keep your books balanced while providing a clear record of where the money came from and how it was used.

If you’ve been wondering, what is double-entry bookkeeping, it’s simply the process of recording transactions using the double-entry method. This method ensures every financial movement is documented in a way that maintains the balance of the accounting equation.

While the terms “accounting” and “bookkeeping” are often used interchangeably, bookkeeping focuses more on the recording and classification of transactions. Think of it as the groundwork for the broader world of accounting.

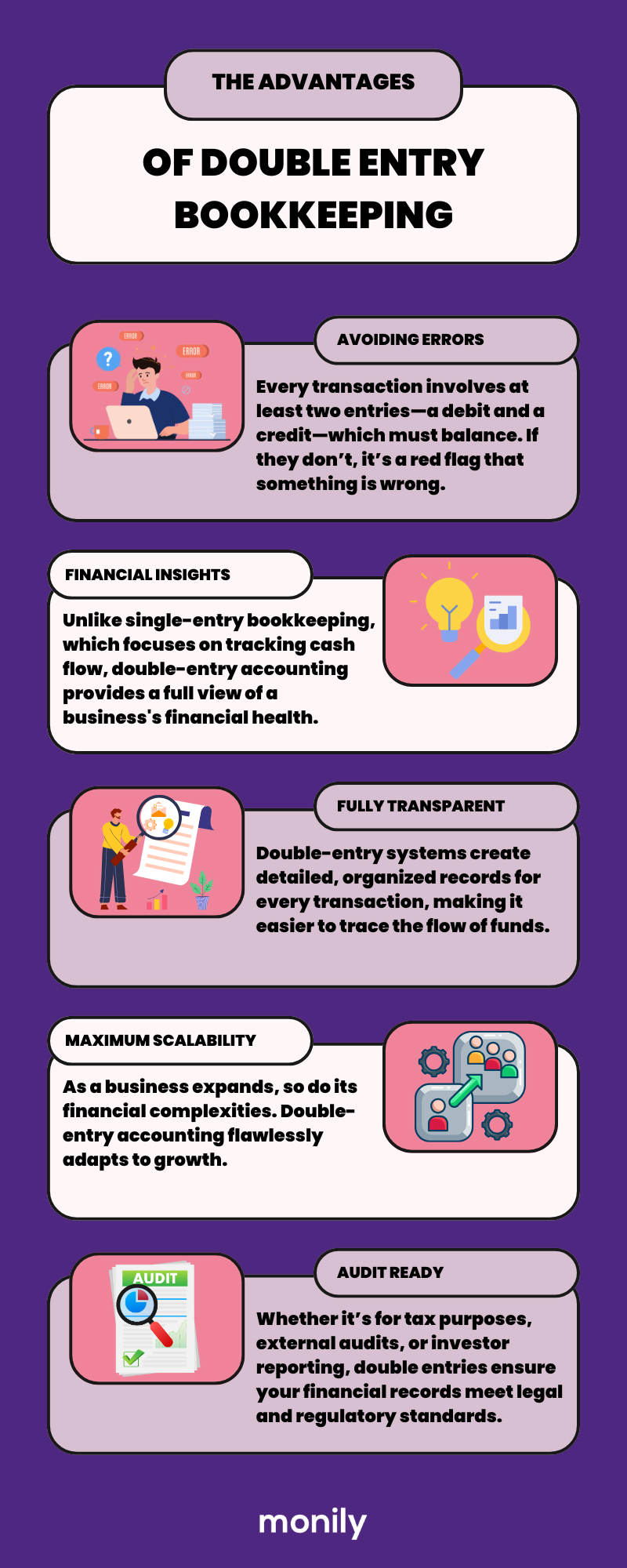

Double-entry accounting has earned its reputation as the most reliable bookkeeping method for a reason. It goes beyond simple record-keeping, offering a range of benefits that make it the preferred system for businesses worldwide. Here’s a deeper dive into its advantages:

One of the standout features of double-entry accounting is its built-in error detection. Every transaction involves at least two entries—a debit and a credit—which must balance. If they don’t, it’s a red flag that something is wrong. This system minimizes the risk of undetected mistakes, ensuring that financial records remain accurate and reliable.

Unlike single-entry bookkeeping, which focuses on tracking cash flow, double-entry accounting provides a full view of a business’s financial health. It captures assets, liabilities, equity, revenue, and expenses, allowing business owners to understand their company’s position at a glance. With these insights, decision-making becomes more informed and strategic.

Double-entry systems create detailed, organized records for every transaction, making it easier to trace the flow of funds. This level of transparency builds trust among stakeholders, including investors, auditors, and regulators. When questions arise, the answers are readily available in your books.

As a business expands, so do its financial complexities. Double-entry accounting flawlessly adapts to growth, accommodating intricate transactions, multiple revenue streams, and complex financial obligations without losing its accuracy or reliability.

Whether it’s for tax purposes, external audits, or investor reporting, double-entry systems ensure your financial records meet legal and regulatory standards. They’re essential for preparing compliant financial statements like balance sheets and income statements.

By adopting double-entry accounting, businesses gain not just a bookkeeping tool but a strategic advantage that supports growth, accuracy, and accountability.

While double-entry accounting is a powerful tool for managing finances, it can be intimidating for beginners. Understanding its challenges and how to address them can make the process much smoother. Here are some of the most common hurdles:

One of the first stumbling blocks is grasping the concept of debits and credits. These terms don’t align with everyday usage, leading to confusion. For example, a debit increases assets but decreases liabilities, while a credit does the opposite.

The key is practice—think of debits as “increases” in what you own or spend and credits as “increases” in what you owe or earn. Using visual aids like T-accounts can also help clarify these concepts.

Ensuring that every transaction balances can feel overwhelming at first, especially when dealing with multiple accounts. Beginners might struggle to identify the correct accounts to debit and credit. The solution lies in double-checking entries and using accounting software, which often automates these processes and flags discrepancies.

For many, the technical nature of double-entry accounting can be a barrier. Business owners with limited accounting knowledge may feel out of their depth. However, plenty of resources—online tutorials, templates, and beginner-friendly software like QuickBooks or Xero—can simplify the learning curve.

As your business grows, the number of accounts and transactions increases, making manual tracking harder. Investing in strong and reliable accounting software ensures scalability and reduces manual errors.

Misplacing entries in the wrong accounts is also often a primary reason that disrupts the accounting equation. Regular account reviews and working with an experienced bookkeeper or accountant can help avoid this.

By understanding these challenges and using the right tools and resources, you can confidently embrace double-entry accounting and unlock its full potential for your business.

As we go through technological advancements in the 21st century, financial clarity becomes more important than ever. Whether you’re applying for a loan, presenting financials to investors, or simply planning next year’s budget, double-entry accounting is your ticket to making informed decisions.

It’s not just about compliance or tradition—it’s about giving your business the solid financial foundation it needs to thrive.

By now, you should have a clear understanding of what is double-entry accounting and why it’s indispensable. But knowledge is only half the battle—putting it into practice is where the magic happens.

Whether you’re just starting your business journey or looking to refine your financial processes, embracing double-entry accounting will set you up for success. So, grab your ledger, choose accounting software, and let the balancing act begin!

Not ready to take it up all on your own? Contact us today and let our experts come in and handle your books for you!

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Running a SaaS business can look simple from the outside. Customers sign up, pay monthly or yearly, and keep using the product. Quite straightforward, right? Behind […]

Learn More →

Revenue is the heartbeat of any SaaS business. But how and when that revenue shows up on your books can change everything, from investor confidence to […]

Learn More →

If you’re a small business, we will absolutely get it if you say you’re having a hard time choosing a payment platform for your company. And […]

Learn More →