November 8 2024 | By Raza Agha | 8 minutes Read

Xero and NetSuite: An Overview

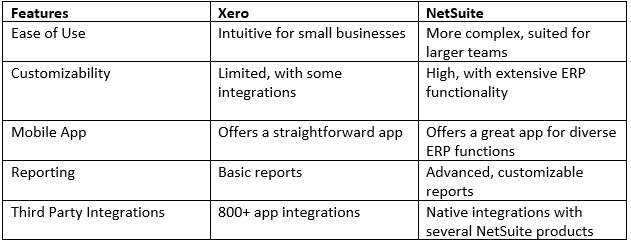

Key Features Comparison

Diving Into the Details

A. User-Friendliness

B. Core Accounting Capabilities

C. Scalability

D. Integration and Customization

Pricing Breakdown

Xero Pricing

NetSuite Pricing

Pros and Cons: Xero vs NetSuite

Xero

Pros

Cons

NetSuite

Pros

Cons

What to Choose and When: Xero vs. NetSuite

Choose Xero if…

Choose NetSuite if…

Xero Drawbacks: What Should You Consider?

NetSuite vs. Xero: Final Verdict

Final Thoughts

In the digital age, choosing the right accounting software can greatly influence a company’s financial efficiency and accuracy. Two leading names in the field, Xero and NetSuite, offer great solutions but cater to different needs.

Understanding the core differences between these platforms will help you decide which aligns with your business requirements. Let’s delve into the comparison of Xero vs NetSuite.

When considering accounting solutions, Xero and NetSuite stand out as two strong yet distinct platforms, each with unique strengths. Xero is a cloud-based accounting software designed primarily for small to medium-sized businesses (SMBs) seeking a simple and affordable solution.

Known for its intuitive user experience, Xero allows business owners and accountants to manage invoicing, payroll, and financial reporting without needing extensive accounting expertise. With over 800 third-party integrations, it adapts well to the specific needs of smaller companies, particularly those focused on straightforward accounting requirements.

NetSuite, however, is more than just accounting software; it’s a complete Enterprise Resource Planning (ERP) solution. While it covers core accounting needs, NetSuite also offers advanced tools for financial planning, CRM, e-commerce, and inventory management.

This makes it an attractive choice for larger businesses or enterprises with complex needs and multi-departmental structures. Designed to scale with businesses as they grow, NetSuite is highly customizable, enabling firms to build processes that restructure diverse operations.

While it comes with a steeper learning curve and higher costs than Xero, NetSuite’s ERP capabilities make it ideal for companies looking to consolidate various business functions within a single, unified system.

Xero: Designed with simplicity in mind, Xero’s user interface is intuitive and user-friendly. Business owners with limited accounting experience will find the platform accessible.

NetSuite: Due to its extensive functionalities, NetSuite has a steeper learning curve. However, for those familiar with ERP systems, NetSuite provides unmatched flexibility and scalability.

When evaluating Xero vs NetSuite in terms of core accounting functions, both platforms cover the basics but with different levels of depth.

Xero offers fundamental accounting features like invoicing, payroll, and expense tracking. However, some users might find that it lacks the depth for complex financial planning, which can be seen as one of the Xero drawbacks.

NetSuite provides advanced features, including multi-entity management, automated workflows, and extensive budgeting and forecasting tools.

Xero: Small businesses benefit from Xero’s affordability and ease of use, but larger businesses might find Xero’s limitations challenging as they grow. Expanding businesses looking for advanced features may encounter Xero drawbacks as their needs evolve.

NetSuite: Designed for scalability, NetSuite is ideal for businesses with complex structures or those expecting growth. The platform supports multiple subsidiaries, currencies, and tax requirements, making it suitable for enterprises operating on a global scale.

Xero: While Xero offers over 800 third-party integrations, customization options are relatively limited, focusing more on simplicity than extensive configurability.

NetSuite: Known for its high level of customization, NetSuite provides built-in modules that support various business processes, allowing organizations to tailor workflows and processes to their needs.

Xero offers three pricing tiers to cater to different business sizes and needs:

Xero’s pricing model is accessible for smaller businesses, though some features in higher-tier plans might be available in NetSuite’s base package.

NetSuite doesn’t publish fixed pricing because it offers custom pricing based on a business’s needs, which can make it challenging for companies without larger budgets. It’s a better fit for businesses that require an extensive ERP system and are willing to invest in stronger infrastructure.

The decision between NetSuite vs Xero ultimately depends on your business’s size, needs, and budget. Here are some considerations to guide your choice:

Your business is small to medium-sized, and you need an easy-to-use accounting platform with basic functionalities. Xero’s affordable pricing and straightforward interface make it ideal for companies that don’t require extensive features.

You’re managing a large, growing business with complex needs. If your organization operates across multiple regions or has diverse departments, NetSuite’s extensive ERP capabilities will provide the necessary tools to boost operations and support growth.

While Xero is a popular choice for small to medium-sized businesses, it has some limitations that may not suit every company. One major Xero drawback is its scalability. While Xero is affordable and effective for small businesses, it lacks the advanced features larger companies may need as they expand.

For instance, businesses that operate across multiple regions or have complex financial reporting requirements may find Xero’s capabilities limited. Its reporting, while sufficient for basic needs, doesn’t offer the depth or customizability that enterprise-level software like NetSuite provides.

Another potential Xero drawback is in its project management and inventory features. While Xero offers these as add-ons in higher-tier plans, they may not be as strong as standalone project management or inventory solutions, and integrating third-party apps can sometimes be awkward.

Additionally, Xero’s payroll functionality is limited in some regions, which may necessitate finding and integrating a separate payroll solution if the business operates internationally.

Furthermore, while Xero integrates with over 800 third-party apps, some users may find its customization options constrained compared to platforms like NetSuite. For businesses anticipating significant growth, these drawbacks could hinder Xero’s long-term viability, prompting them to consider more scalable ERP solutions like NetSuite.

When choosing between Xero vs NetSuite, consider the following questions:

The Xero vs NetSuite debate reflects the distinct strengths each platform brings to the table. Xero is an accessible, user-friendly option suited to small businesses, while NetSuite is a comprehensive ERP solution ideal for companies with larger, complex structures.

By evaluating your current needs and anticipating future growth, you can make an informed decision that ensures your accounting processes align well with your operational goals.

Choosing the right software is a strategic investment in your business’s future, and understanding the nuances of Xero vs NetSuite can help you find the perfect fit.

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Running a SaaS business can look simple from the outside. Customers sign up, pay monthly or yearly, and keep using the product. Quite straightforward, right? Behind […]

Learn More →

Revenue is the heartbeat of any SaaS business. But how and when that revenue shows up on your books can change everything, from investor confidence to […]

Learn More →

If you’re a small business, we will absolutely get it if you say you’re having a hard time choosing a payment platform for your company. And […]

Learn More →