June 20 2025 | By Farwah Jafri | 5 minutes Read

What is a Fractional CFO?

What Factors Affect Fractional CFO Cost?

Experience Level

Scope of Work

Company Size and Complexity

Engagement Model

Fractional CFO Hourly Rate in 2025

Monthly and Project-Based Fractional CFO Rates

How Much Does a Fractional CFO Cost?

When It’s Time to Hire A Fractional CFO?

How Do We Help at Monily

Running a business is no small feat, and when it comes to managing finances, the stakes are even higher. You need expert advice, smart strategies, and someone who can see the bigger picture. But hiring a full-time CFO? That can be sometimes impossible for your already strained budget.

That’s where the fractional CFO comes in. You get the knowledge and insights from a seasoned financial expert, without paying a hefty, six-figure salary.

Wondering how much does a fractional CFO cost in 2025? Let’s break it down for you right here, in this blog.

Ah! The big question.

Before we dive into numbers and reiterate why having a fractional CFO is a great idea, let’s first tell you what exactly a fractional CFO is and what it does.

A fractional CFO is a part-time or contract-based Chief Financial Officer who works with your business for a set number of hours per week or month. They offer the same high-level financial expertise as a full-time CFO but without a full-time salary, that often makes in-house CFOs unaffordable for small businesses.

The fractional CFO rates can vary based on a few key factors:

A CFO with decades of experience and industry specialization may charge more than someone newer to the role. This is because fractional CFOs with years of experience have a lot more to offer to their partner businesses than someone who is still learning and gaining knowledge.

Are you looking for someone to help with fundraising and investor relationships? Do you just need someone to keep books clean and manage cash flow? Or are you interested in a fractional CFO for financial forecasting? The scope of the work highly impacts the fractional CFO hourly rate.

A startup with a simple financial model may have to pay less to their fractional CFO compared to a growing company with multiple revenue streams. If you’re a small to mid-size business in the early stage, the cost of the CFO will be way less for you than a growing enterprise.

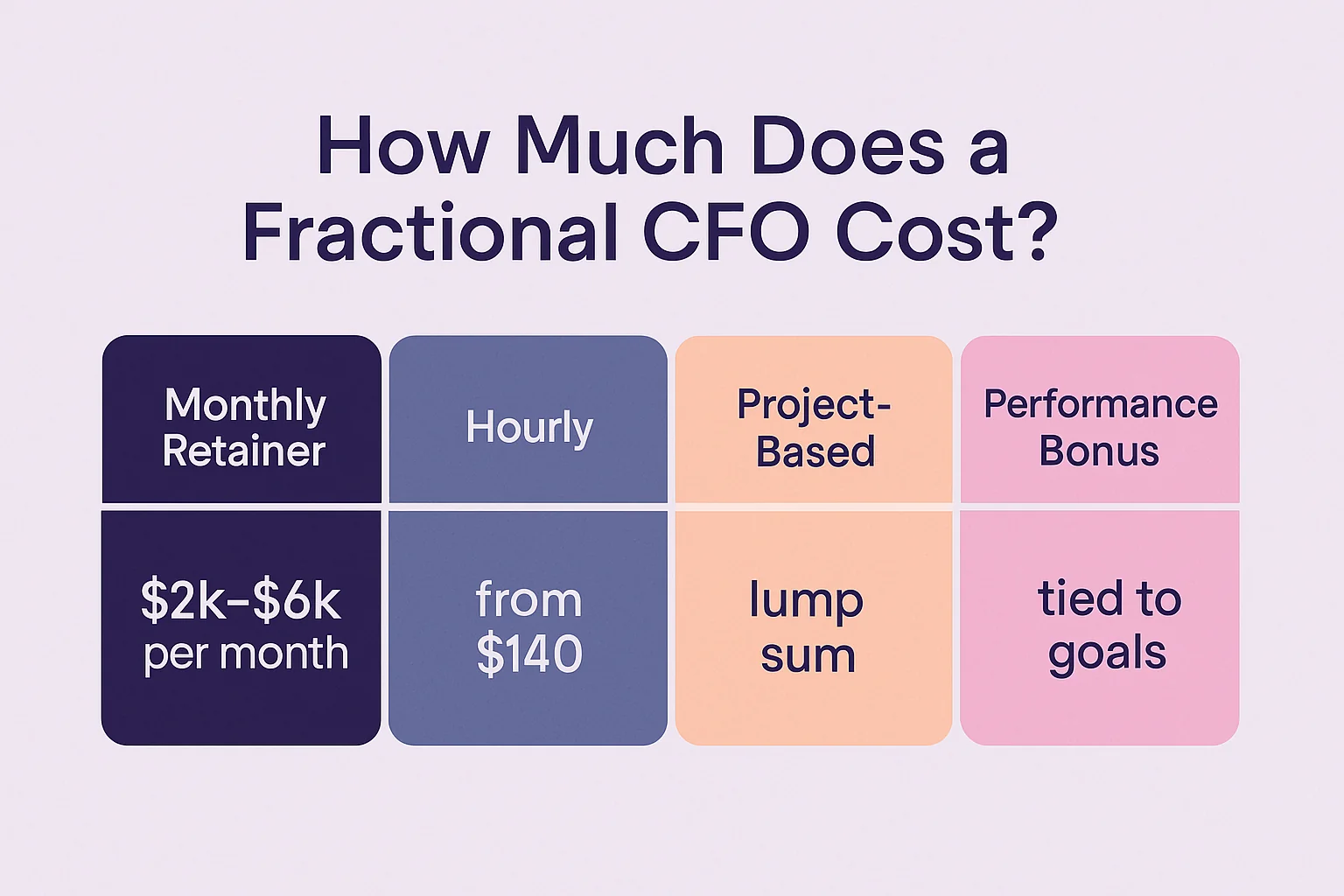

Lastly, how much you need the CFO also affects the fractional CFO rates. Per-hour, monthly rates, or project-based retainers are some of the options to consider.

In 2025, the fractional CFO hourly rate typically ranges between $150 to $450 per hour.

The fractional CFO hourly rate can also depend on location. CFO in major markets like New York or San Francisco tend to charge more, while those in the smaller cities or remote positions may slightly be more affordable.

Some business owners prefer to pay on monthly retainer instead of hourly. This can often be more predictable and better suited for ongoing support.

In 2025, fractional CFO rates on a monthly basis usually fall between:

Keep in mind that fractional CFO rates might also change depending on the specific project. For example, a short-term fundraising project or preparing for an audit might cost more than regular monthly check-ins and financial reporting.

Source: https://alexejpikovsky.com/how-to-hire-fractional-cfo/

Here’s a quick summary:

The good news is that with a fractional CFO, you only pay for what you need. And a fractional CFO cost comes without the overheads incurred in benefits you’re obliged to pay a full-time employee.

If you’re still wondering whether you actually need a fractional CFO, here are some signs:

At Monily, we understand that every business is different. That’s why we offer flexible fractional CFO hourly rates tweaked to your exact needs and budget.

Whether you’re a startup gearing up for a seed round or a growing business trying to make sense of your financial data, we have got your back! With our affordable fractional CFO costs, you get to enjoy the expertise, clarity, and insights of a seasoned financial guru without bearing the full-time costs.

Book a consultation with us today to learn more about our fractional CFO services.

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Starting a business is great, right? You have a wonderful idea, an enthusiastic team, and a product or service that offers solutions to your target market. […]

Learn More →

Startups are popping up everywhere nowadays. That doesn’t mean all of them will turn out to be successful. As startups grow, managing a business and its […]

Learn More →

Do I need a CFO? What does a CFO do? Should I hire a CFO? Questions like these are common among startup owners and entrepreneurs who […]

Learn More →