June 10 2025 | By Wajiha Danish | 5 minutes Read

Starting a business is great, right? You have a wonderful idea, an enthusiastic team, and a product or service that offers solutions to your target market.

But as your business grows (again a wonderful thing to happen), managing money becomes difficult. This is where you look around, wondering who will save the day for your rapidly growing startup.

Fortunately, a CFO for startups works in this situation!

But how do you find a CFO that works for your startup? Do you even need a full-time CFO? What about a fractional CFO? What’s that?

If you’re a startup owner with too many questions, then we are Monily with all the answers! So, read this blog below and we’ll walk you through everything you need to know about CFOs for startups.

Before we tell you how to choose a CFO for your startup, it’s only fair that we explain to you why you need one. After all, it’s not an easy decision or one that’s super cost-effective (unless we tell you about fractional CFOs).

As a startup founder, your plate is already too full. You’re handling product development, customer acquisition, recruitment, and even raising capitals. All of this can lead you somewhere, where financials take the backstage. And truth be told, without solid financial planning your startup is flying almost blind.

So, to make sure that you know whether you’re profiting or just burning cash, it’s important to have a CFO by your side.

A CFO brings financial clarity to startups that’s otherwise missing. They help you track numbers, plan budgets, manage investor relationships, and make smarter financial decisions. In short, CFOs make sure that your startup grows without running out of money.

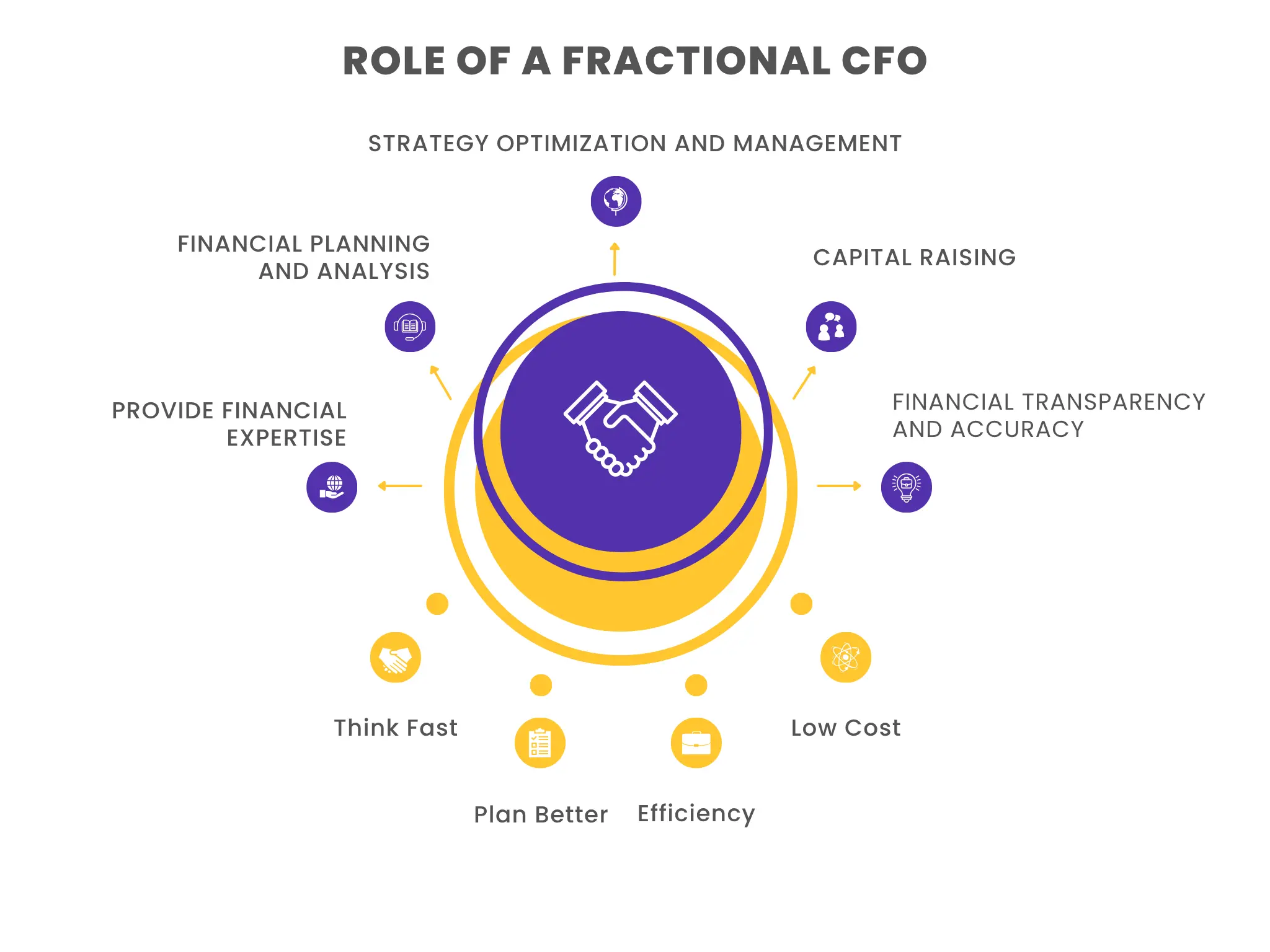

So, what does a CFO do in a startup? A lot than crunching numbers! They manage everything from financial forecasting and reporting to fundraising and devising growth strategies. CFOs ensure that startups aren’t just operating but rather gearing towards success.

Here’s why having a CFO for startups is so important:

While the answer for this isn’t the same for every startup, here are some key signs that your startup may need a CFO now:

So, we have figured out why you need a CFO for startups. But how to find one that fits your needs? Here are some tips on choosing the right financial leader whether full-time or on a fractional basis:

As your startup grows, so does you need to have an expert financial advisor by your side. A CFO for startups can easily fit in the role and help your startup reach its goals while ensuring financial stability.

But, of course, not all startups can afford to hire a full-time CFO (especially those in the infancy stage). This is why we offer fractional CFO services at Monily. Our team of financial experts have industry knowledge of startups, great attention to detail, and a knack for helping their teams thrive.

So, if you’re a startup owner who knows that it’s time to hire a CFO, we suggest you check out our CFO services for startups. We are pros at helping startups like yours take control of their finances while working on strategies that fulfill long-term goals.

Book a consultation with us today and let us know how our fractional CFOs can help your startup succeed.

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Running a business is no small feat, and when it comes to managing finances, the stakes are even higher. You need expert advice, smart strategies, and […]

Learn More →

Startups are popping up everywhere nowadays. That doesn’t mean all of them will turn out to be successful. As startups grow, managing a business and its […]

Learn More →

Do I need a CFO? What does a CFO do? Should I hire a CFO? Questions like these are common among startup owners and entrepreneurs who […]

Learn More →