May 15 2025 | By Farwah Jafri | 5 minutes Read

LLCs (Limited Liability Companies) are popular business structures across the US. Often, small business owners prefer to form an LLC owing to a wide variety of tax benefits offered by this structure. However, many small business owners struggle to understand the complexities of LLC tax brackets which in turn can impact on the finances of a business negatively.

We understand that LLC tax rules can be confusing, therefore, having professional guidance comes in handy when preparing or filing taxes for your LLC corporation. So, if you wish to ensure that your business does not suffer from financial mismanagement or worse a penalty for failing to comply with LLC taxes, here’s a guide.

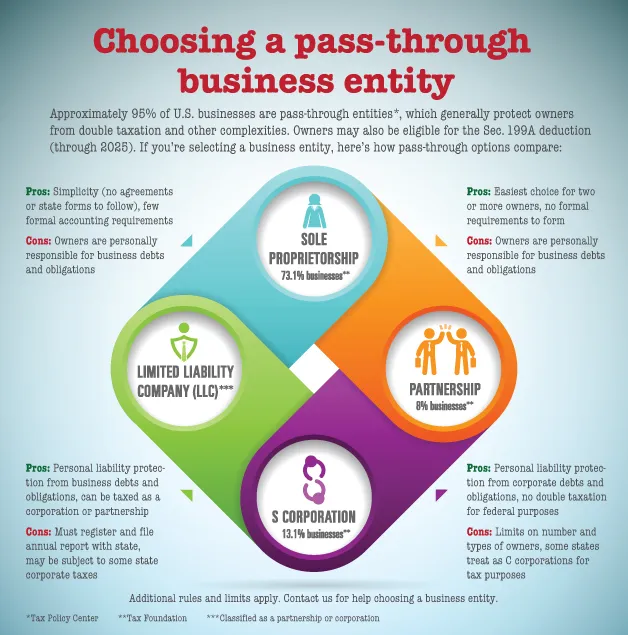

Before we dive into the details, let’s start with the basics. The biggest benefit of forming an LLC is that it’s not taxed as a separate entity. Instead, the tax burden of an LLC falls upon its owners and members. This pass-through taxation system means that any losses or profits generated by the LLC pass through to its owners who then report them on their individual tax returns.

This is a significant advantage for small business owners as this pass-through system allows business owners to avoid double taxation.

The tax rate and bracket that applies depends on how an LLC is taxed. Different LLCs have different tax options including getting taxed as a sole proprietorship, partnership, S corporation, and C corporation. Each of these options have different tax rates for LLCs and criteria through which a business becomes eligible for the said tax option.

For 2025, there have been some changes to the tax brackets and rates for LLCs. Understanding these is essential to not only learn how taxes will work but also to ensure that you do not pay more than what’s required of your small business.

The IRS sets LLC tax brackets every year taking into account inflation adjustments and new tax legislation. While this year’s tax brackets and rates for LLCs are somewhat similar to last year, there are some IMPORTANT UPDATES that small business owners must know about.

Here’s a breakdown of what the tax rate for small business LLC will look like this year:

Since LLC tax brackets are tied to the owners reporting them on their individual tax returns, the above-mentioned tax rates are for individual owners. So, for an LLC business owner generating a revenue up to $250,525, a 32% tax rate will apply.

However, for a married couple jointly filing their taxes as LLC owners, here’s the breakdown of the typical tax rate for LLC:

To put it simply, a married couple jointly earning $731,200 or more will pay up to 37% of their LLC income in taxes.

Lastly, those who are wondering about their tax rate for small business LLC as the head of a household, here’s what your tax brackets will look like in the year 2025:

Now, an individual who is filing their tax returns as the head of a household with their LLC business generating $191,950, a 24% tax rate will be applicable.

If you wish to manage your tax burden and maximize the benefits, then understanding the tax brackets for different LLC structures is crucial.

For LLCs taxed as a sole proprietorship and partnership, owners will pay taxes as per individual tax brackets. However, if your LLC comes under an S corporation or a C corporation, then you’ll need to consider different tax rates applicable to S and C corporations.

One of the biggest benefits of getting taxed as an S corporation is that it can help you save on self-employment taxes – consider talking to a tax expert and finding out more;

Navigating tax brackets for LLCs can be a tad bit confusing, especially if you’re a new business owner venturing into this world for the first time. But what if we told you taxes can be simplified?

At Monily, we help thousands of small business owners with their taxes across the US. We understand the struggle that comes with being a small business and have an array of solutions to help you navigate this territory without falling into pitfalls. From bookkeeping to tax preparation and much more, we are here to help you every step of the way.

Interested in knowing more about our services? Book a consultation with our experts right away!

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Running a small business means every dollar matters. You work hard to earn revenue, manage expenses, and grow steadily, yet tax time often feels like money […]

Learn More →

Tax season can be overwhelming, especially when you’re staring at multiple forms with numbers instead of names. Two of the most common, and often misunderstood, are […]

Learn More →

Working extra hours can feel rewarding, after all you’re putting in more time, showing dedication, and earning more money. But when you look at your paycheck, […]

Learn More →