May 28 2025 | By Raza Agha | 6 minutes Read

Why Startups Need Tax Experts

Key Factors to Consider When Choosing a Tax Provider

1. Experience with Startup Tax Preparation

2. Understanding of Tax Services for Startups

3. Tech-Savvy and Up to Date with 2025 Tax Laws

4. Clear Pricing and No Hidden Fees

5. Availability and Responsiveness

Questions to Ask a Tax Provider

Some Mistakes to Avoid

Turnaround Your Startup Financials

Starting a new business is exciting, but it does come with a long checklist – funding, hiring, marketing, and yes, of course, the good old taxes.

For many entrepreneurs, tax season can feel overwhelming, especially if you have never done this before. Naturally, if you’re not prepared, you might miss important deductions, file late, or face penalties. That is why, startup tax preparation is a key part of running a successful business.

But is it possible to crack the code of tax preparation on your own? More often than not!

This is where a tax expert comes into the picture. The right tax expert, who knows and suits your business, can help you stay compliant, save money, and plan for future growth – a must have for startup ventures.

So, how do you find the right professional quickly? Specially with the tax laws changing in 2025, this is a question many entrepreneurs ask. Thankfully, this blog has all the answers!

In this blog, we will tell you what to look for in a tax expert, what questions to ask, and what mistakes to avoid when choosing a startup tax provider. Whether you’re starting a tech startup, an online boutique, or an online confectionary store, this is the blog you should be reading today.

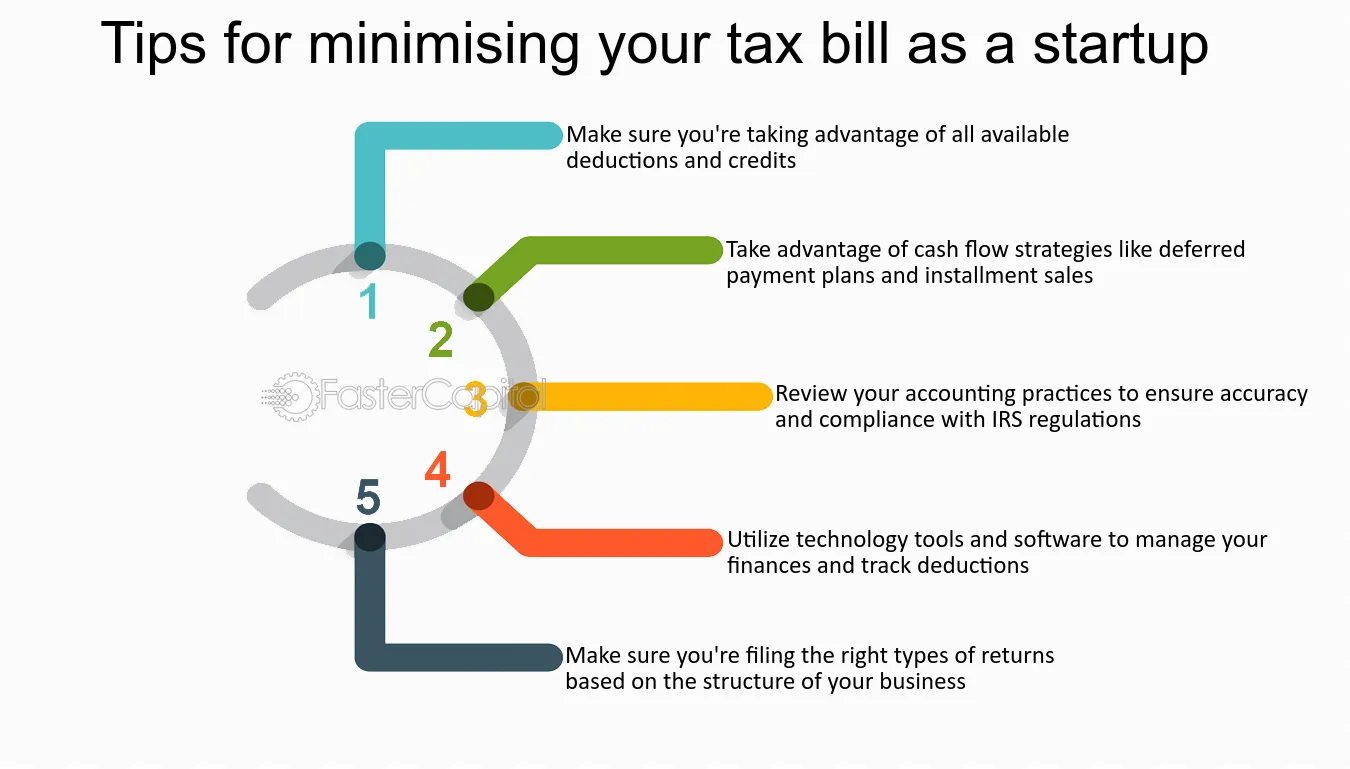

Source: fastercapital.com

Let’s answer the big question first.

Startups have very different needs compared to well-established companies. From managing investor funding to handling employee equity plans, the financial side of a startup is complex to say the least. That’s where tax experts come in to play a big role.

Many startups operate at a loss in their initial years but can still take advantage of the deductions and credits (like the R&D credit) that can reduce their tax burden. A tax expert who understands tax services for startups can guide you in claiming these benefits.

Plus, decisions made early on such as choosing a business structure (LLC, S-Corp, or C-Corp) can impact how much tax you end up paying. Having a qualified tax professional ensures those decisions are made with the right information.

In addition, things like financial recordkeeping, filing taxes on time, and preparing for audits are some of the important tasks that a startup tax preparation expert can help with, quite easily!

Simply put, tax experts help you avoid mistakes, maximize savings, and focus on what matters the most in your business.

Here are five important factors every startup founder should think about when choosing a tax expert in 2025.

Startups aren’t like traditional businesses. You may have seed funding, stock options, early-stage losses, and a growing team. A tax professional who specializes in startup tax preparation understands these unique challenges. They’ll know how to handle early losses, R&D credits, and even founder equity. Ask the tax professional about their experience with similar startups before.

A good tax expert will do more than just file your returns. They will also provide full-scale tax services for startups, including planning, strategy, and compliance. This also includes advice on quarterly tax payments, deductible expenses, and entity structure. Look for someone who helps you throughout the year and not just during tax season.

Tax laws change often and 2025 is no different. Your tax provider should be current on all IRS updates and new tax codes. They should also know how to use digital tools to make your experience smooth. Cloud-based software, digital document uploads, and secure communication channels help save time and prevent errors; and your tax provider must not shy away from any of these modern-day solutions.

Startup budgets are tight, and we all know it too well. That’s why it’s important to know upfront what you’ll pay. Some tax providers charge flat fees, while others bill by the hour. Be sure to ask what’s included in their pricing and if there are any extra costs. A reliable tax provider will give you clear, honest pricing, and help you plan for business tax preparation without surprises.

Startups move fast, and you will need a tax expert who can keep up with the pace. If you have questions or urgent needs, you should be able to reach out to your tax provider quickly. Ask about response times and whether they offer support outside of the tax season. Good communication and availability show that your business tax provider values your business and is keen to grow with you.

Once you have found a few potential tax experts, asking the right questions can help you make the best decision. Here are some questions to include in your search:

Startup tax preparation doesn’t have to be stressful or confusing. With the right tax provider, you’ll gain peace of mind, save money, and set your business for long-term success.

It’s 2025 and now it’s more important than ever to work with a tax professional who understands the needs of startups, has industry knowledge, and offers round the clock assistance.

At Monily, we believe startups deserve financial experts who move at their pace. That’s why we step up and offer customized startup tax preparation services. Specializing in business tax preparation and tax solutions, we are your go-to tax service for startups.

If you’re ready to simplify your startup tax prep, then let us help you. Book a consultation now to get started on small, stress-free tax preparation for your startup.

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Running a small business means every dollar matters. You work hard to earn revenue, manage expenses, and grow steadily, yet tax time often feels like money […]

Learn More →

Tax season can be overwhelming, especially when you’re staring at multiple forms with numbers instead of names. Two of the most common, and often misunderstood, are […]

Learn More →

Working extra hours can feel rewarding, after all you’re putting in more time, showing dedication, and earning more money. But when you look at your paycheck, […]

Learn More →