May 23 2024 | By Wajiha Danish | 8 minutes Read

What is an Operating Cycle?

Key Consideration: Operating Cycle vs. Cash Cycle

How to Calculate Operating Cycle?

Let’s Break it Down Further

This Brings Us To…

Operating Cycle Formula Calculation: An Example

Step 1: Calculate her Days Inventory Outstanding

Step 2: Calculate Days Sales Outstanding

Step 3: Calculate the Operating Cycle

FAQs

How can I improve my company’s operating cycle?

Why should the operating cycle formula matter if my marketing and finance are already efficient?

What are some of the effects of operating cycle on a business’ operations?

Industry Examples

Final Thoughts

Tracking your company’s operating cycle throughout the year is often the best way to gauge how your business is performing and whether it is headed towards growth. It can also shed some light on whether your business is efficient and if yes then by what margin. Thus, the operating cycle formula can be useful.

However, the formula isn’t really all you need to know. Although you must understand how to calculate the operating cycle if you want to compare yourself to your competitors, it is also important to understand what it really means for your business.

In the following sections, we will go through what an operating cycle really is and why it is important for a business to track it. We will also shed some light on how it works, how one can calculate it, and how to make it insightful for your business.

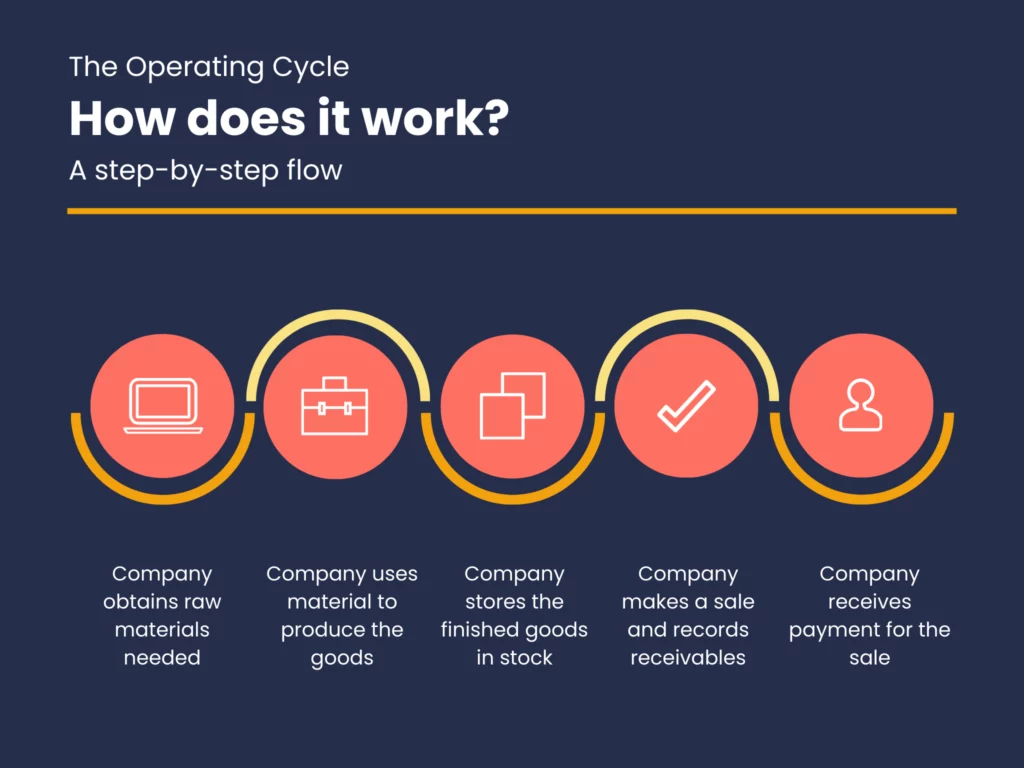

Let’s dive into the basics. An operating cycle usually refers to the amount of time it takes for a company to buy its stock in inventory, sell it off, and receive cash in return from the sale of its products (this can even apply to services, although that can often get tricky).

Every industry works differently, which means that the length of this operating cycle can vary from one niche to another. However, the basic concepts remain the same. Understanding your operating cycle can help you determine your financial health as it can give you a great indication of the company’s ability to pay off its liabilities in due course.

For example, a business with a shorter operating cycle would tend to quickly sell out its stock and get the cash it needs to pay back the debt. The shorter the cycle, the easier it is to pay off the debt, and the quicker the business can grow!

An operating cycle is quite different from a cash cycle. Although they are both useful calculations for a business, the insights differ widely. Cash cycles usually analyze the cash flow in much more depth and tell a company how well they can manage their cash flow, while an operating cycle involves how efficiently the stock flows in and out.

The operating cycle formula adds the days inventory outstanding to the days inventory outstanding. In simple terms, it measures the specific time it took for the company to purchase the inventory, sell the finished goods, and collect cash from the customer who paid on credit.

As illustrated above, the start of the cycle involves purchasing the raw material to create the product. By the end of the cycle, that material has been successfully converted into the end product and sold, with the cash received in full.

What is the days inventory outstanding and the days sales outstanding? How does one calculate it? Let’s follow the steps;

Days Inventory Outstanding (DIO) = (Average Inventory ÷ Cost of Goods Sold) × 365 days

Days Sales Outstanding (DSO) = (Average Accounts Receivable ÷ Revenue) × 365 days

The operating cycle would then be calculated as;

Operating Cycle = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO)

Although the operating cycle formula is straightforward, diving deeper into the calculations that lead to the DIO and the DSO can lead to deeper insights.

For example, the days sales outstanding value could be higher simply because the process to collect the credit purchases is inefficient and needs to be worked on. Yet, when it comes to the days inventory outstanding calculations, a higher value could point towards inefficiency in moving inventory. Thus, understanding where the figure is coming from allows you to make much more informed decisions.

TIP:

LOWER OPERATING CYCLE – THIS IS A POSITIVE INDICATION, WHEREBY THE COMPANY’S OPERATIONS ARE WHERE YOU WANT THEM TO BE

HIGHER OPERATING CYCLE – IT TAKES LONGER FOR THE INVENTORY TO BE SOLD OR FOR THE REVENUE TO BE COLLECTED WHICH POINTS TOWARDS INEFFICIENCY

Why is the operating cycle formula important? Why do we need to calculate it?

There are a few reasons why calculating this formula can benefit your business.

Let’s calculate the operating cycle for Cindy, who has been managing a startup for custom shoes. Here are her financials for the first two years of the business;

Year 1

Revenue: $80 million

Cost of Goods Sold: $50 million

Inventory: $15 million

Accounts Receivable: $10 million

Year 2

Revenue: $100 million

Cost of Goods Sold: $70 million

Inventory: $20 million

Accounts Receivable: $12 million

Let’s calculate her operating cycle;

To improve your company’s operational process and reflect better figures through the operating cycle formula, it is essential to pay close attention to the accounts receivable turnover, average payment periods, and the inventory turnover.

The operating cycle can also be made more efficient by managing your accounts payable well. This means you might need to reduce the time it takes for your customers to pay back for the product they purchased before they make a new purchase. You can also benefit from a smaller inventory cycle, which means you might need to shrink the time between raw materials entering your business and the final product being sold to a customer.

Working on your operating cycle can also benefit many other parts of your business. This includes marketing and finance.

For example, if you manage to recover your debts on time, there is a much lower possibility of bad debt and subsequent accumulation. This means you have more money to spend on the finance and marketing department which may be able to generate much more revenue.

Having less account receivables can also better many other ratios for the business, which are important for investors who may want to provide money for funds. Any negative effects from your operating cycle on other aspects of your business may reflect badly on your business’s future profitability.

An effective operational process can help your business improve their cash flow, which can inevitably affect your market share. The more efficient your sales force is in pushing out that inventory, the more your sales, in less time.

Similarly, if you have an efficient production process, you can produce many finished goods to provide to your sales force. The operating cycle, when it is short, can reduce many costs associated with your stock, accounts receivable, and administrative expenses. This means there is much more money left over to invest.

One of the best examples of a company with the ideal operational efficiency is Toyota. Toyota’s production system utilizes a lean manufacturing system which reduces waste and continuously improves the inventory system by constantly evaluating it. This means they avoid overproducing and holding excess inventory over time.

The operating cycle formula is a great addition to insights you may want to analyze for your business frequently. This can keep you updated on the efficiency of your inventory process, which provides insights time and again to help you reduce wastage and improve your overall processes.

Monily’s financial experts can help you get the job done in the most efficient manner, with the least amount of hassle. In fact, you can kick back and relax as we help you optimize your operating cycle by providing insights that can help you understand where you need to be!

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Running a SaaS business can look simple from the outside. Customers sign up, pay monthly or yearly, and keep using the product. Quite straightforward, right? Behind […]

Learn More →

Revenue is the heartbeat of any SaaS business. But how and when that revenue shows up on your books can change everything, from investor confidence to […]

Learn More →

If you’re a small business, we will absolutely get it if you say you’re having a hard time choosing a payment platform for your company. And […]

Learn More →