October 23 2024 | By Shoaib Jamil | 8 minutes Read

The Basics: What is a Recurring Transaction?

Why Recurring Transactions Are Everywhere

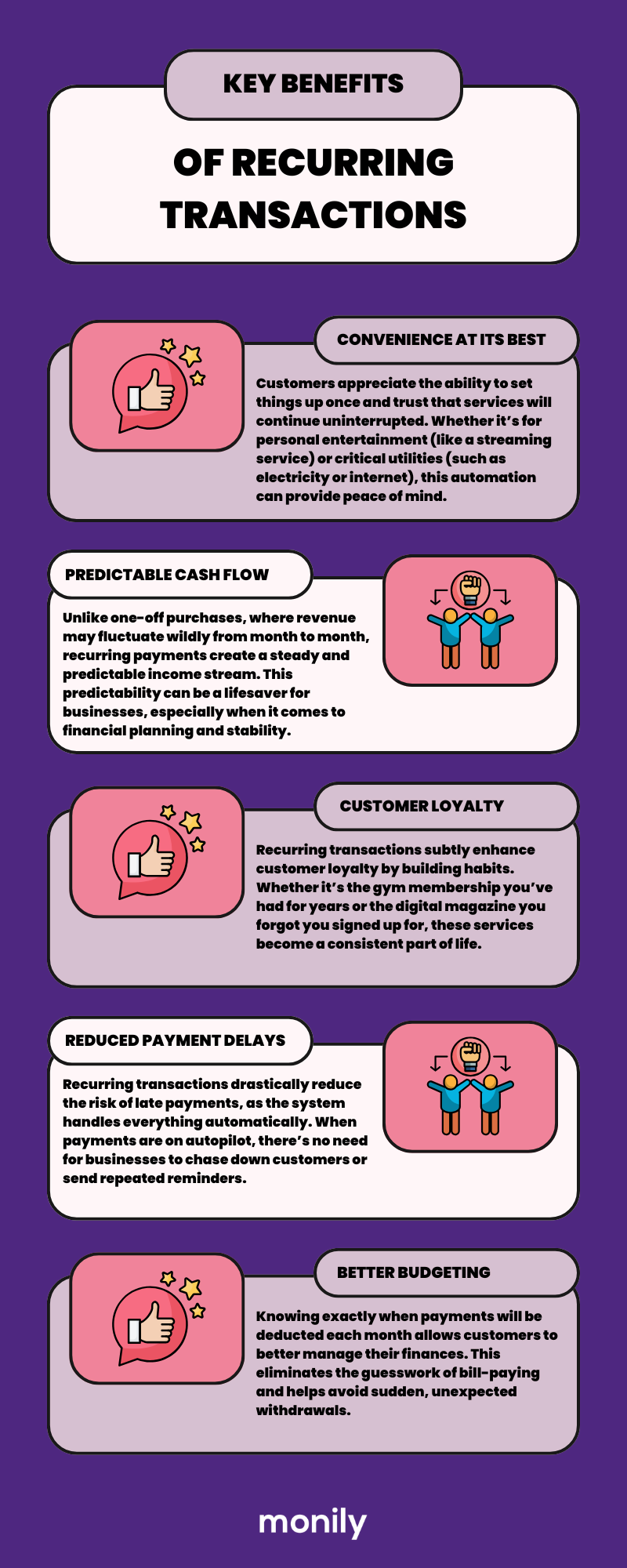

The Key Benefits of Recurring Transactions

1. Convenience at Its Best

2. Predictable Cash Flow for Businesses

3. Boost Customer Retention and Loyalty

4. Reduced Payment Delays and Administrative Burden

5. Improved Financial Planning and Budgeting for Customers

Popular Types of Recurring Transactions

Is a Recurring Transaction Right for Your Business?

Final Thoughts: Why Recurring Transactions Matter

Have you ever signed up for a service that magically charges your account every month without you lifting a finger? Congratulations, you’ve experienced the magic of a recurring transaction!

But what is a recurring transaction exactly, and why is it such a game-changer for businesses and consumers alike? Let’s uncover the wonders of recurring transactions, along with their key benefits.

A recurring transaction is a payment that happens on a regular schedule—think of your Netflix subscription or your monthly gym membership. Instead of making a one-time payment each time you need a service, recurring transactions allow you to set it and forget it.

Once authorized, payments happen automatically, ensuring uninterrupted service for the user and consistent revenue for businesses.

Recurring transactions are practically everywhere—whether you realize it or not. From your favorite streaming services to your utility bills, these transactions make life a lot simpler.

But they aren’t just for consumers; businesses love them too! For companies, recurring payments mean a steady, predictable income stream, while for customers, it’s all about convenience. The “set it and forget it” mindset is a big win for both sides.

Let’s say you’re a small business owner. You might offer subscriptions, memberships, or services billed monthly, quarterly, or annually. Recurring transactions allow you to keep your business running smoothly, without the hassle of chasing down late payments.

Plus, customers love the idea of signing up once and not worrying about missing a payment or losing access to services they love.

Now that we’ve covered the basics, let’s dive into the juicy details—why are recurring transactions so beneficial? Here’s what makes them stand out for both businesses and consumers:

Convenience isn’t just a luxury today—it’s a necessity. Recurring transactions embody convenience by automating the payment process.

Think about it: with a simple one-time setup, customers no longer have to remember due dates or repeatedly enter payment details. This benefit extends beyond reducing minor hassles—it creates a smoother, more seamless experience that fits perfectly into busy lives.

For businesses, this convenience means less time spent manually processing payments or following up with customers. Billing cycles run like clockwork, freeing up resources that can be focused elsewhere, like improving products or providing better customer support.

This process also reduces administrative costs, since employees no longer need to manage invoices or track down late payments manually. It means more time and energy can be dedicated to scaling the business or improving customer experience.

Customers appreciate the ability to set things up once and trust that services will continue uninterrupted. Whether it’s for personal entertainment (like a streaming service) or critical utilities (such as electricity or internet), this automation can provide peace of mind.

No more worrying about missed due dates or service interruptions—everything just works in the background, like clockwork.

If there’s one thing business owners strive for, it’s reliable cash flow. Recurring transactions offer exactly that.

Unlike one-off purchases, where revenue may fluctuate wildly from month to month, recurring payments create a steady and predictable income stream. This predictability can be a lifesaver for businesses, especially when it comes to financial planning and stability.

Let’s take a subscription-based business, for example. Knowing that payments will arrive consistently at set intervals allows the business to plan better for future investments, staffing needs, or product development.

Cash flow predictability also reduces stress for business owners, as they no longer have to worry about chasing invoices or dealing with uncertain payment timelines.

Additionally, the assurance of recurring revenue can help when seeking financing. Lenders and investors often view businesses with steady cash flow as lower-risk ventures, making it easier to secure loans or attract investors for expansion. Recurring payments provide a strong foundation for long-term growth, allowing businesses to focus on innovation rather than scrambling to cover short-term costs.

Customers who sign up for recurring payments are more likely to stick around. Why? Because recurring transactions lower the friction between the customer and the service.

Once someone is signed up, they don’t have to go through the process of re-entering information or making a decision to pay every month. This reduces the likelihood of them canceling or switching to a competitor.

Recurring transactions subtly enhance customer loyalty by building habits. Whether it’s the gym membership you’ve had for years or the digital magazine you forgot you signed up for, these services become a consistent part of life.

Over time, customers become more attached to the value they receive and less likely to cancel, simply because the payment process is so frictionless.

Businesses can use recurring transactions to focus on strengthening relationships with customers, rather than constantly seeking new ones. A loyal customer base means less churn, reduced acquisition costs, and more opportunities to upsell or cross-sell other products and services. Plus, satisfied customers are more likely to spread the word, creating organic growth through referrals.

Late payments can be a nightmare for businesses. They not only disrupt cash flow but also take up valuable time and energy in the follow-up process. Recurring transactions drastically reduce the risk of late payments, as the system handles everything automatically. When payments are on autopilot, there’s no need for businesses to chase down customers or send repeated reminders.

This benefit becomes particularly crucial for service-based industries, where timely payments are essential for uninterrupted service delivery. For example, if you run a cloud storage service or a subscription-based online tool, late payments could lead to access issues for customers, impacting the user experience and potentially leading to cancellations. By ensuring that payments are always on time, recurring transactions protect businesses from these disruptions.

On the administrative side, businesses can reduce their reliance on manual payment tracking and bookkeeping. Automated billing software can handle the processing, reconciliation, and reporting, saving countless hours and reducing the risk of human error.

In fact, many recurring payment systems integrate directly with accounting software, making it easier to manage revenue, forecast future income, and generate financial reports with minimal effort.

Customers benefit from recurring transactions not just because they simplify payments, but also because they offer greater predictability in personal budgeting. Knowing exactly when payments will be deducted each month allows customers to better manage their finances. This eliminates the guesswork of bill-paying and helps avoid sudden, unexpected withdrawals.

For those who juggle multiple services or subscriptions, recurring transactions provide a level of financial stability. Imagine managing five different subscription services manually. The chances of missing a payment, getting hit with late fees, or even losing track of one entirely are high. With recurring transactions, everything fits into a predictable schedule, offering customers more control over their cash flow.

Moreover, recurring payments help customers avoid debt or penalties associated with late fees. Automated payments mean there’s no risk of forgetting to pay a bill and getting slapped with an extra charge. For many, this can be the difference between a balanced budget and overspending. It’s a financial safety net that helps people stay on top of their obligations.

By now, you’re probably thinking, “Okay, I get that recurring transactions are convenient, but where do I encounter them most?” Here’s a look at some of the most common types of recurring payments you probably use regularly:

If you run a business and are wondering whether adopting recurring transactions is the right move, the answer is probably yes! Recurring transactions are perfect for companies offering services that customers use regularly. Whether it’s a subscription-based service or membership, the benefits are hard to overlook.

However, recurring transactions may not be ideal for businesses that offer one-off products or services. In those cases, it’s more about making sure customers are satisfied enough to come back on their own rather than locking them into a long-term payment plan.

Still, if your business model fits, offering recurring payments can be a game-changer for growth and customer loyalty.

Recurring transactions are the unsung heroes of the modern payment world. Whether you’re a business owner looking to simplify your payment processes or a customer looking for convenient ways to pay for services, recurring transactions deliver a win-win situation.

With benefits like improved cash flow, better customer retention, and reduced late payments, it’s no wonder so many companies are adopting this model.

Next time you wonder, “What is a recurring transaction?” just remember it’s more than just an automatic payment—it’s a key tool for building a smoother, more efficient financial system. Be it paying your monthly gym fees or offering a subscription service, recurring transactions are here to make life just a little bit easier.

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Running a SaaS business can look simple from the outside. Customers sign up, pay monthly or yearly, and keep using the product. Quite straightforward, right? Behind […]

Learn More →

Revenue is the heartbeat of any SaaS business. But how and when that revenue shows up on your books can change everything, from investor confidence to […]

Learn More →

If you’re a small business, we will absolutely get it if you say you’re having a hard time choosing a payment platform for your company. And […]

Learn More →