September 20 2024 | By Raza Agha | 8 minutes Read

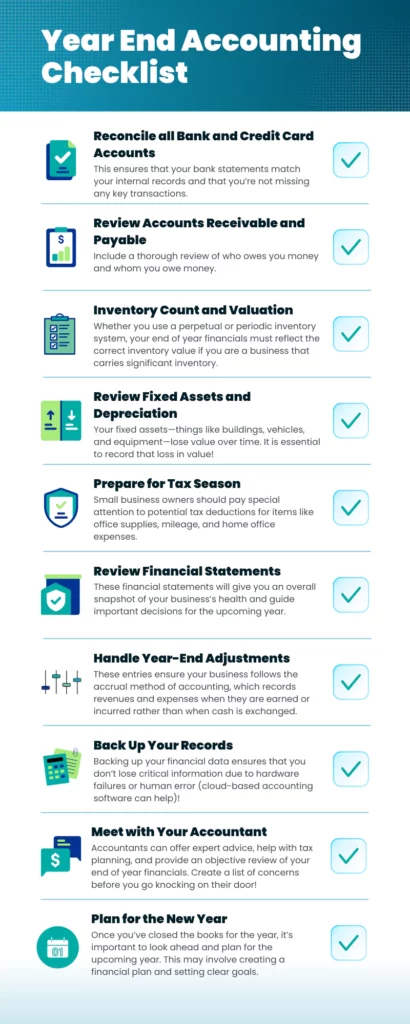

1. Reconcile All Bank and Credit Card Accounts

How to Do It:

2. Review Accounts Receivable and Payable

How to Do It:

3. Inventory Count and Valuation

How to Do It:

4. Review Fixed Assets and Depreciation

How to Do It:

5. Prepare for Tax Season

How to Do It:

6. Review Financial Statements

How to Do It:

7. Handle Year-End Adjustments

How to Do It:

8. Back Up Your Records

How to Do It:

9. Meet with Your Accountant

How to Do It:

10. Plan for the New Year

How to Do It:

Wrapping Up Your Complete Year-End Accounting Checklist

As the year draws to a close, business owners and finance teams face the exhausting task of wrapping up their financial records. Closing out your books properly doesn’t just consist of following protocol—it’s supposed to focus on ensuring your business starts the new year on a strong financial footing. A well-executed year-end accounting checklist can help you tackle this process efficiently and avoid future headaches.

In this guide, we’ll break down key steps you need to close your books, giving you a thorough year-end bookkeeping checklist. Whether you’re a seasoned accountant or a small business owner handling your own finances, this checklist will help you breeze through the end of year financials with confidence.

Why It Matters: Reconciling your accounts is one of the first steps that should exist in any year-end checklist for accounting. It ensures that your bank statements match your internal records and that you’re not missing any key transactions.

Pro Tip: Use accounting software to automatically pull in your bank statements for a more efficient reconciliation process.

Having a clean reconciliation not only makes tax season easier but also gives you a better idea of your cash flow.

Why It Matters: To maintain accuracy through your year-end accounting checklist you must include a thorough review of who owes you money and whom you owe money. This ensures that your books reflect the true financial position of your business.

Pro Tip: This is also an excellent time to evaluate your accounts receivable turnover rate. Slow payments might indicate a need to adjust your collection process in the coming year.

Why It Matters: For businesses that carry inventory, year-end physical counts and valuation are essential steps for accurate financial reporting. Whether you use a perpetual or periodic inventory system, your end of year financials must reflect the correct inventory value.

Pro Tip: An inventory write-down or write-off may be necessary if your inventory is damaged or obsolete. These adjustments can affect your financial reports and tax filings.

Why It Matters: Your fixed assets—things like buildings, vehicles, and equipment—lose value over time. Ensuring that depreciation is properly recorded is a crucial part of your year-end checklist for accounting.

Pro Tip: Many accounting software programs can automate depreciation calculations. If you haven’t done so already, consider setting up depreciation schedules to save time in the future.

Why It Matters: One of the most noteworthy reasons for having a strong year-end accounting checklist is to prepare for tax season. Making sure your records are complete and up-to-date will save you stress and help avoid last-minute scrambles.

Pro Tip: Small business owners should pay special attention to potential tax deductions for items like office supplies, mileage, and home office expenses.

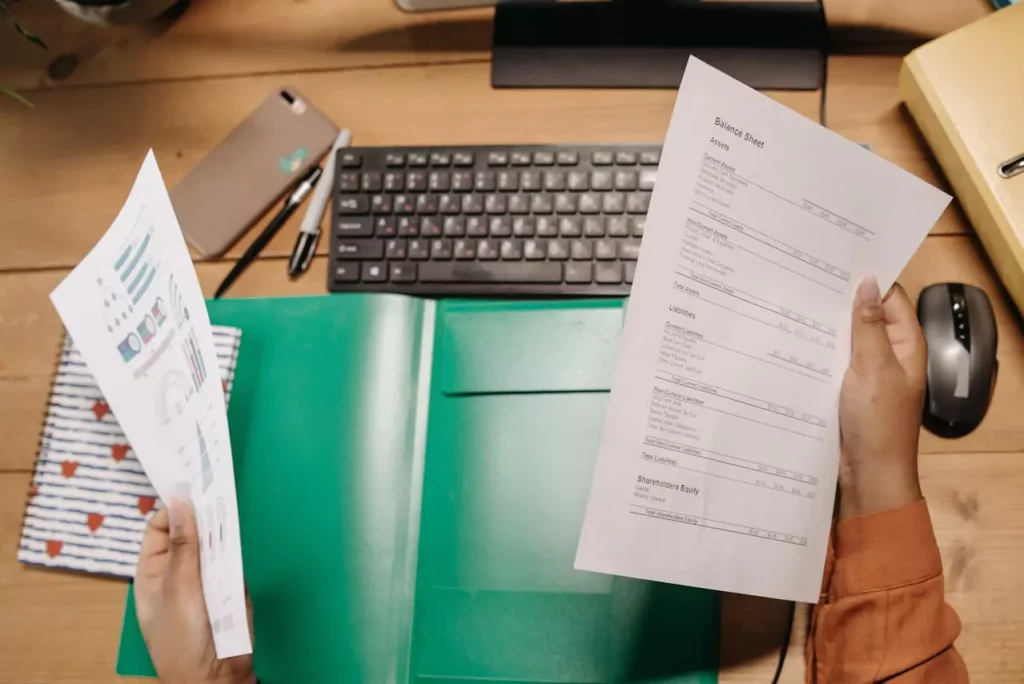

Why It Matters: Once you’ve gone through your reconciliation, inventory, accounts payable, and receivable, it’s time to review your end of year financials. These financial statements will give you an overall snapshot of your business’s health and guide important decisions for the upcoming year.

Pro Tip: Compare your current financials with previous years to spot trends. Are sales growing or shrinking? Are your costs increasing? These insights can help you fine-tune your financial strategy for the new year.

Why It Matters: Adjusting entries are often necessary at year-end to correct inaccuracies in your financial statements. These entries ensure your business follows the accrual method of accounting, which records revenues and expenses when they are earned or incurred rather than when cash is exchanged.

Pro Tip: Don’t forget to review your owner’s draw account, especially if you’re a sole proprietor or in a partnership. It’s essential to reconcile this with the business’s overall equity.

Why It Matters: The final task on your year-end accounting checklist may seem mundane, but it’s one of the most important. Backing up your financial data ensures that you don’t lose critical information due to hardware failures or human error.

Pro Tip: Consider switching to cloud-based accounting software that automatically backs up your data, giving you one less thing to worry about.

Why It Matters: Even if you’ve followed this year-end accounting checklist precisely, meeting with a professional accountant can help ensure everything is in order. Accountants can offer expert advice, help with tax planning, and provide an objective review of your end of year financials.

Pro Tip: Bring a list of questions or concerns to your accountant meeting to make the most of your time together. Whether it’s advice on cash flow management or potential tax implications, this conversation can help guide your financial decisions in the coming year.

Why It Matters: Once you’ve closed the books for the year, it’s important to look ahead and plan for the upcoming year. Creating a financial plan and setting clear goals can help you better manage your business’s cash flow and make informed decisions.

Pro Tip: Use your end of year financials as a baseline for setting your new goals. Having clear benchmarks will make it easier to track your progress throughout the year.

Planning for the new year ensures you’re not just reacting to financial situations as they arise, but proactively managing your business’s growth and sustainability.

The end of the year is a time to close the books, reflect on your business’s financial health, and prepare for the new year. By following this year-end accounting checklist, you’ll ensure that your records are accurate, your tax season is stress-free, and your business is set up for success in the upcoming year.

Whether you’re wrapping up your year-end bookkeeping checklist or fine-tuning your end of year financials, these steps provide a practical guide to closing your books. With a little preparation and attention to detail, you’ll start the new year with financial clarity and confidence.

Use this guide as a resource, and remember: a well-executed year-end checklist for accounting doesn’t just benefit you today—it sets the stage for a better tomorrow. If you are wondering where you’d find the time to follow a year-end checklist, don’t worry! Monily’s experts can guide the way. Reach out and take advantage of our experts who can help you prepare for a better fiscal year ahead!

Subscribe for business tips, tax updates, financial fundamentals and more.

MORE BLOGS

Running a SaaS business can look simple from the outside. Customers sign up, pay monthly or yearly, and keep using the product. Quite straightforward, right? Behind […]

Learn More →

Revenue is the heartbeat of any SaaS business. But how and when that revenue shows up on your books can change everything, from investor confidence to […]

Learn More →

If you’re a small business, we will absolutely get it if you say you’re having a hard time choosing a payment platform for your company. And […]

Learn More →